<a href="http://www.flickr.com/photos/30268017@N03/6799967776/sizes/m/in/photostream/">EN2008</a>/Flickr

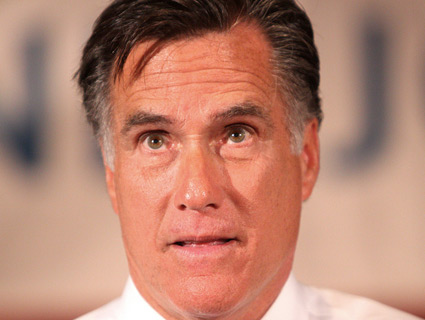

Unlike Mitt Romney, most Americans who will pay their taxes today can’t afford fancy accountants. But Romney has reluctantly made public his tax returns, and thus shared valuable strategies to ensure that he pays a far lower rate than, say, Warren Buffett’s secretary. Citizens for Tax Justice recently waded through Romney’s 2010 return—in which his $22 million in income was miraculously taxed at just 13.9 percent—to come up with a handy primer for how you, too, can beat the IRS at its own game. To paraphrase:

1. Don’t work for a living

The tax rate on money earned actually working (“salaries and wages”) can be more than double the rate on money earned sitting around watching your investments go up in value (“capital gains”), thanks to the work of other people. Almost all of Romney’s income is taxed as capital gains.

2. If you work, disguise your compensation as capital gains

About half of the $15 million in capital gains and dividend income Romney reported in 2010 was actually compensation for his work at Bain Capital. But using a tax loophole favored by private-equity guys, he was able to get paid by taking equity stakes in deals that he put together (“carried interest,” in tax parlance) instead of in the proletarian form of a fully taxable salary. Bonus: This allowed Bain to avoid paying Medicare payroll taxes.

3. Give to charity—but not with cash, checks, or money orders

In 2010, Romney was able to write off $1.5 million worth of Domino’s Pizza stock he donated to a charity. It is likely that he originally received the stock as compensation from Bain, in which case the price he paid for it would have been close to zero. In this scenario, by donating the stock instead of selling it and donating the cash, Romney would have saved about $220,000 in taxes.

4. Give to charity—but not now

Romney’s return reports income from the W. Mitt Romney 1996 Charitable Remainder UniTrust. Not only is the trust tax exempt, but when Romney set it up 16 years ago, he got a tax deduction for making a charitable donation. Though the money in the trust is eventually supposed to go to charity, Romney can receive income from the trust for a number of years—quite possibly for the rest of his life.

5. Give to charity—your own

In 2010 Romney made a tax-deductible, $1.5 million donation to the Tyler Charitable Foundation, which he controls. Commanding your own foundation allows you to curry favor with political and business allies by donating money to their pet organizations and causes. For instance, in 2010 the Tyler Charitable Foundation donated $100,000 to to the George W. Bush Library.

6. Do not invest in America

Certain foreign investment vehicles allow you to avoid certain taxes. For example, Romney’s Individual Retirement Account could bypass the Unrelated Business Income Tax by investing through a foreign corporation. Though it’s hard to know whether Romney availed himself of those kinds of savings, he has invested substantially in foreign entities, including ones based in offshore tax havens such as Bermuda, the Cayman Islands, and Luxembourg.

7. Invest in sexy financial instruments

Romney earned $415,000 from an investment that gets special tax treatment: Through an accounting loophole, 60 percent of the profits from the investment are treated as long-term capital gains, a designation that has tax benefits, no matter how long the investment is held.

8. Borrow money to invest

While you can’t deduct interest from car loans or credit cards, you can write off interest on the money you borrow to make certain types of investments—for instance, if you borrow from a broker to buy stock (a “margin loan”). Portfolio management fees are also write-offs. A fellow like Romney, who makes his millions mainly from investments, could probably deduct a fair sum.

9. Push the limits of the law

When you engage in a type of transaction that the IRS views as potentially abusive, you must disclose it in a separate form. In 2010, Romney filed six such forms.

10. Be part of the 1 percent

When it comes to taxes, it costs money to save money. You’ll need to hire lawyers to help you set up tax-exempt charities and trusts or exploit offshore tax havens—and a professional money manager if you plan to invest in sexy financial instruments. It probably won’t be cost effective if you aren’t already rich, but any hard-working son of a governor can land a job at a private-equity firm and start getting paid in carried interest. Bonus: You might make enough money to one day run for president.