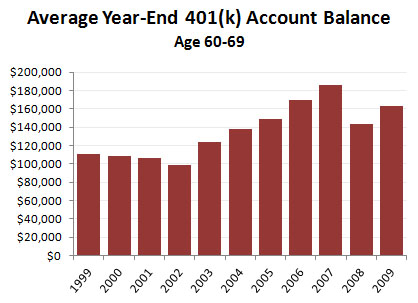

Last week I put up a post showing average 401(k) retirement account balances. However, that data was for all 401(k) accounts, including young workers, and that’s obviously of limited usefulness. What we’d  really like to know is the average account balance for people nearing retirement.

really like to know is the average account balance for people nearing retirement.

The chart on the right, based on data from EBRI, provides a rough idea. Very rough. First of all, it’s a mean, not a median, so it’s skewed upward by the small number of participants with very large balances. The median number is likely half the mean. Second, it includes only people who have contributed consistently to their 401(k) accounts since 1999. This also skews the number upward since it excludes people with spotty work records, who are most likely to have small balances.

So take it with a grain of salt. But it’s a data point, and I wanted to pass it along. One thing it shows clearly is the significant drop from 2007 to 2008, when workers near retirement saw their account balances fall by 25 percent in a single year. At the same time, it also shows that within a year, account balances had rebounded to within a few thousand dollars of their 2006 values, and had increased by nearly half since the start of the decade. The lesson here is that, on average, 401(k) balances have done reasonably well for people who contributed consistently, but also that they’re pretty volatile and shift a considerable amount of risk onto workers. Back in the days of defined-benefit pensions, that risk would have been borne by corporations or investment funds.