I’ve been reading about Wall Street’s fabulous Gaussian copula function for some time, but aside from a vague notion that it was a rocket science method of measuring risk, I’ve never had the slightest idea what it was actually all about. In this month’s Wired, Felix Salmon explains. Basically, it’s a clever way of figuring out whether the odds of two different bonds defaulting are correlated. If they are, then bundling them together into a single security is risky since there’s a good chance they’ll both go into the toilet at the same time.  If they aren’t, bundling them together is fairly safe since even if one of them defaults, at least the other one is still safe. Its inventor was a math guru named David X. Li:

If they aren’t, bundling them together is fairly safe since even if one of them defaults, at least the other one is still safe. Its inventor was a math guru named David X. Li:

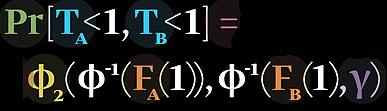

In 2000, while working at JPMorgan Chase, Li published a paper in The Journal of Fixed Income titled “On Default Correlation: A Copula Function Approach.” (In statistics, a copula is used to couple the behavior of two or more variables.) Using some relatively simple math — by Wall Street standards, anyway — Li came up with an ingenious way to model default correlation without even looking at historical default data. Instead, he used market data about the prices of instruments known as credit default swaps.

….When the price of a credit default swap goes up, that indicates that default risk has risen. Li’s breakthrough was that instead of waiting to assemble enough historical data about actual defaults, which are rare in the real world, he used historical prices from the CDS market…..Li wrote a model that used price rather than real-world default data as a shortcut (making an implicit assumption that financial markets in general, and CDS markets in particular, can price default risk correctly).

Hmmm. The implication here is that the fundamental problem with the Gaussian copula — which was the mathematical basis behind the proliferation of CDOs, CLOs, and all the other shiny new investment vehicles that imploded so spectacularly last year — is that it was based on the relatively brief historical record of credit default swaps. I don’t have any doubt that that’s true, but a few paragraphs later the real villain turns out to be a familiar one:

“Everyone was pinning their hopes on house prices continuing to rise,” says Kai Gilkes of the credit research firm CreditSights, who spent 10 years working at ratings agencies. “When they stopped rising, pretty much everyone was caught on the wrong side, because the sensitivity to house prices was huge. And there was just no getting around it. Why didn’t rating agencies build in some cushion for this sensitivity to a house-price-depreciation scenario? Because if they had, they would have never rated a single mortgage-backed CDO.”

There’s just no getting around it: there might have been technical problems with the Gaussian copula function, but even if it had worked the way people thought it did it wouldn’t have mattered. The rating agencies and the sell-side BSDs were just using it as an excuse to pretend that house prices would rise forever anyway. That was a far more fundamental problem than the statistical shortcomings of the formulae they used.

Still, it’s an intriguing piece that’s worth reading. You can put it alongside Joe Nocera’s piece last month on Value at Risk, yet another quant model developed at JPMorgan whose wide misuse contributed mightily to our current economic meltdown. When common sense takes a holiday, it turns out, all the math in the world can’t save you.