The Census Bureau reported today that income inequality increased in 2008. Megan McArdle reacts:

The Census Bureau reported today that income inequality increased in 2008. Megan McArdle reacts:

I’m a little surprised; the work of Piketty and Saez seems to suggest that the incomes of the wealthy are disproportionately affected by crises, because they destroy so much asset value. This effect may show up in the 2009 numbers, when the full effect of the carnage in the markets will be seen in high-end incomes.

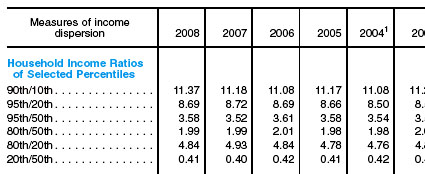

My guess is that the destruction of asset values disproportionately affects only the very rich. The top 10% are mostly just like the rest of us, but with a little more money, while the top 1% are quite different, relying for a lot of their income on capital gains and bonuses tied to asset values. (And demonstrating a lot more income volatility, too.) When Piketty and Saez produce their numbers for 2008, I wouldn’t be surprised if income inequality has increased a bit if you look at 90/10 comparisons, but decreased a bit if you look at 99/10 or 99.9/10 comparisons.