The Wall Street Journal reports on the future of employee benefits in America. Or, rather, their lack of a future:

The Wall Street Journal reports on the future of employee benefits in America. Or, rather, their lack of a future:

Since the downturn began, thousands of employers have cut pay, increased workers’ share of health-care costs or reduced the employer contribution to retirement plans.

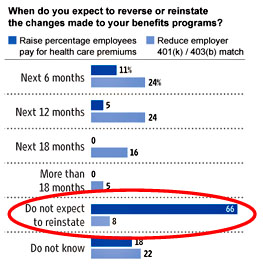

Two-thirds of big companies that cut health-care benefits don’t plan to restore them to pre-recession levels, they recently told consulting firm Watson Wyatt. When the firm asked companies that have trimmed retirement benefits when they expect to restore them, fewer than half said they would do so within a year, and 8% said they didn’t expect to ever.

….”I think we’ve entered into a fundamentally new era,” says David Lewin, of the Anderson School of Management at the University of California, Los Angeles. He describes employers as “leery of long-term commitments,” including both benefits and pay increases.

Now, obviously this has to be taken with a grain of salt. In the same survey, for example, 22% of employers say they never intend to reinstate the salary reductions they made during the recession. That may well be their intent, but these folks all have to pay market wages, and if market wages go up then they’ll have to follow suit whether they like it or not.

Still, intent isn’t nothing, and a long jobless recovery certainly makes it easier for employers to make good on promises like this — and maintaining cuts to benefit levels is even easier. Outside of Wall Street, things are looking grim.