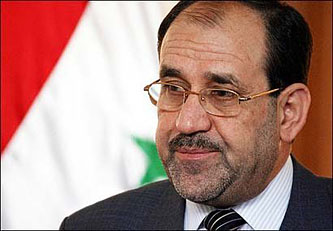

Juan Cole surveys the state of the Iraqi electorate and suggests that the State of Law coalition, which includes Nouri al-Maliki’s Dawa party, may be ready to abandon Maliki in order to make a better deal elsewhere:

Juan Cole surveys the state of the Iraqi electorate and suggests that the State of Law coalition, which includes Nouri al-Maliki’s Dawa party, may be ready to abandon Maliki in order to make a better deal elsewhere:

The London pan-Arab daily al-Hayat [Life] reports in Arabic that that the Shiite State of Law coalition and the Shiite Iraqi National Alliance say they are prepared to make an alliance before they enter the new parliament. This move reduces the chance that current prime minister Nuri al-Maliki will get a second term.

….The fundamentalist Iraqi National Alliance groups Muqtada al-Sadr’s Free Independents with Ammar al-Hakim’s Islamic Supreme Council of Iraq and other religious Shiite parties….The Sadrists, the leading bloc within the National Iraqi Alliance, deeply dislike al-Maliki because he sent the army in after their paramilitary, the Mahdi Army, in both Basra and Sadr City in spring-summer of 2008. The State of Law may well have to sacrifice him to get an alliance with the more religious Shiite parties.

Abdul Hadi al-Hassani of the State of Law […] said he expected the two to merge, given that they were most compatible in their platforms. He downplayed Sadrist dislike of al-Maliki and said what was important is that the two have a similar governing structure and could settle issues by a vote. He envisaged a further partnership, with the Kurdistan Alliance and with the Accord Front (Sunni fundamentalists).

It sounds as though the State of Law leadership is entirely prepared to throw al-Maliki under the bus to get the votes required to form a government.

With Ayad Allawi’s al-Iraqia coalition running neck-and-neck with State of Law, they might not have much choice. But who will the Kurds ally with?