Flickr/<a href="http://www.flickr.com/photos/unfocusedbrain/2214125181/">BlankBlankBlank</a> (<a href="http://www.creativecommons.org">Creative Commons</a>).

Over at MoJoBlog, Andy Kroll declares that “Sen. Chris Dodd (D-CT) has dealt the death blow to consumer protection.” He’s talking about the Consumer Finance Protection Agency, a proposed federal agency that would (in Elizabeth Warren’s words) regulate financial products the same way we regulate toasters. Republicans have been opposed from the start to a CFPA with teeth, and Dodd has finally given in. Here’s the PowerPoint version of his latest proposal:

- Instead of being an independent agency, the CFPA has morphed into a Bureau of Financial Protection within the Treasury Department.

- The BFP would regulate large banks and mortgage companies. However, it would have no authority over banks with assets of less than $10 billion and it would have no authority over other non-bank financial institutions. (The BFP can petition for authority over other financial sectors, but this is almost certainly a fig leaf. It would never get it.)

- States that want to enforce higher consumer standards for financial products wouldn’t be allowed to. The BFP preempts all state regulation.

- The BFP would have to confer with existing bank regulators before making any new rules, and its rules could be overriden by the Systemic Risk Council.

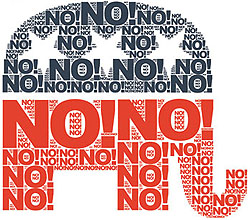

I don’t have a good sense of how much Dodd is to blame for this toothless state of affairs. After all, Republicans instantly rejected even this watered-down proposal, objecting to the “rule-writing power Dodd proposed for the consumer division.” But if they’re objecting to rule-writing power, then they’re simply objecting to anything that might have even the slightest chance of being effective. It’s all kabuki.

This, far more than healthcare reform, is the most disturbing evidence of America’s broken politics. After all, healthcare was always bound to be brutally partisan. Democrats and Republicans have been disagreeing about national healthcare for decades and there was no reason to think it would be different in 2009. We liberals may not like the result so far, but it was hardly unexpected.

But financial reform is different. Sure, Republicans are generally less enthusiastic about corporate regulation than Democrats. This was never going to be a chorus of Kumbaya. But Republicans aren’t philosophically opposed to preventing economic meltdowns, and if there’s anything that should have inspired even  conservatives into agreeing that Wall Street needed to be reined in a wee bit, it was the reckless financial excesses of the aughts and the unprecedented economic devastation it provoked. The entire country is suffering through a grueling economic downturn that’s the worst since the Great Depression, the collapse of 2008 makes the case for regulation almost irresistable, and even the GOP’s tea party base is ready to lynch bankers on sight. The political case for regulation could hardly be more powerful.

conservatives into agreeing that Wall Street needed to be reined in a wee bit, it was the reckless financial excesses of the aughts and the unprecedented economic devastation it provoked. The entire country is suffering through a grueling economic downturn that’s the worst since the Great Depression, the collapse of 2008 makes the case for regulation almost irresistable, and even the GOP’s tea party base is ready to lynch bankers on sight. The political case for regulation could hardly be more powerful.

But that hasn’t made a lick of difference. Not a lick. On an issue where the facts on the ground were so compelling that Democrats and Republicans should have been easily able to forge a consensus for serious change despite philosophical differences, there’s been barely even a recognition from conservatives that anything went wrong. It’s as if Democrats had responded to 9/11 by flatly opposing any action whatsoever to beef up our anti-terrorist capabilities.

So what now? Unlike healthcare, where a weak bill is still worth passing because it might lead to stronger reforms in the future, I don’t think you can say that about this. An agency with no rulemaking authority isn’t going to suddenly gain some later on. It will just be one of those indestructible bureaucratic barnacles, taking up space in some federal office building forever without ever accomplishing anything.

Writing a decent bill and making Republicans kill it might provide Democrats with some kind of partisan advantage. Maybe. But passing Dodd’s current proposal, let alone something even weaker, would certainly have no substantive effect, either now or in the future. There’s literally no point in bothering to bring it to the floor. After going through the greatest financial catastrophe of our lifetimes, brought on by forces we understand perfectly well, we’re going to do nothing to keep it from happening again. That’s a broken government.

UPDATE: Paul Krugman writes essentially the same thing here. At this point, no bill might be better than what it’s possible to pass in the face of Republican opposition.