This is going to be unbearably wonky, so I apologize in advance. But I was thinking some more about Paul Krugman’s contention that Obama’s tax compromise plan might hurt his reelection chances rather than help them. He bases this on two things. First, Mark Zandi’s economic forecast suggests that the tax plan will improve GDP growth in 2011 but reduce it in 2012 (compared to a baseline forecast). Second, Larry Bartels has shown that voters are myopic: they pay far more attention to growth in election years than in other years.  So other things being equal, a plan that lowers 2012 growth is bad for Obama even if it delivers higher immediate growth in 2011.

So other things being equal, a plan that lowers 2012 growth is bad for Obama even if it delivers higher immediate growth in 2011.

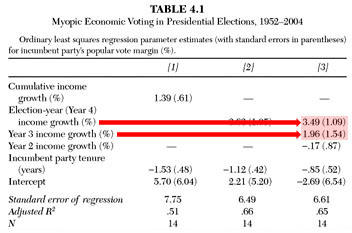

But this all depends on what the actual numbers are, so I went back to Bartels’ model to see what it said. The table on the right (from Unequal Democracy) shows his findings. Every percentage point of income growth in a president’s third year increases his vote margin by 1.96 points. Every percentage point of income growth in an election year increases his vote margin by 3.49 points.

So how does that work out? Zandi figures that the tax plan increases GDP by 1.1 points in 2011 and reduces it by 0.8 points in 2012. So:

(1.1 * 1.96) – (0.8 * 3.49) = -0.6

In other words, the tax plan reduces Obama’s vote margin by 0.6 percentage points compared to Zandi’s baseline forecast. However, there are some caveats:

- Bartels’ model is based on income growth, but Zandi only provides numbers for GDP growth. So those are the numbers I plugged in. However, Zandi also forecasts that unemployment would be lower than the baseline in both 2011 and 2012 if the tax plan passes. Since employment is strongly linked to income, this suggests that the delta in income growth will probably be less than the delta in GDP growth, and this in turn suggests that if we plugged proper income numbers into Bartels’ model it would look more favorable for the tax plan.

- The tax plan acts as kind of an insurance policy against falling back into recession. This is worth quite a bit.

- I think the payroll tax cut will be allowed to expire at the end of 2011, as planned. But it might be extended, and if it is then the tax plan will look considerably better in 2012.

- Zandi’s baseline forecast assumes that some of the Bush tax cuts are extended but not all of them. But there’s no real reason to think that deal is on the table. The real baseline is that all the tax cuts expire, and Obama’s tax deal is obviously far better than that in both 2011 and 2012.

- The error bars on Bartels’ model are quite large since he only has about a dozen data points to work with.

In other words, Krugman has a point. However, my guess is that when you look at the whole picture, along with the fuzziness of the models, it’s most likely that the tax plan basically has an effect size of zero compared to Zandi’s baseline plan and a highly positive effect compared to letting the Bush tax cuts expire completely.

Politically, then, it’s a good idea to pass the plan compared to doing nothing, and substantively it’s a good idea to pass the plan because it will have an immediate effect on economic growth and unemployment. I’d rather do something now with the option of doing more later if we need to, rather than nothing now and kicking ourselves later because it’s too late and the economy is in a ditch.