I’m trying to figure out if I should care about this:

President Obama announced Friday that he is forming a new economic advisory council and hailed the business leader he has appointed to head it, General Electric chief executive Jeffrey Immelt, as an innovator who can advance its core mission of promoting job creation and competitiveness.

On the one hand, Immelt is already on the existing version of this board, and it doesn’t seem to be a very influential position anyway. So if Obama wants to suck up to the business community by appointing Immelt chairman, there’s no real harm done.

On the other hand, seriously? The head of General Electric? A company that long ago became as much shadow bank as industrial manufacturer? A company that was right at the center of the 2008 financial meltdown? A company that was  part of the TARP bailout? Mike Konczal points us to Raj Date’s paper last year about the potential impact of the Senate financial reform bill:

part of the TARP bailout? Mike Konczal points us to Raj Date’s paper last year about the potential impact of the Senate financial reform bill:

Considering the “Killer G’s” — Goldman Sachs, GMAC, and GE Capital — can be especially instructive. Their business models are quite different from each other, but they share crucial common features: each was a shadow bank that ex-ploited a regulatory loophole to avoid bank holding company supervision; each took on substantial credit or liquidity risk during the bubble; each faced the possibility of catastrophic capital or liquidity shortfalls; and each was deemed too big to fail and rescued by taxpayers.

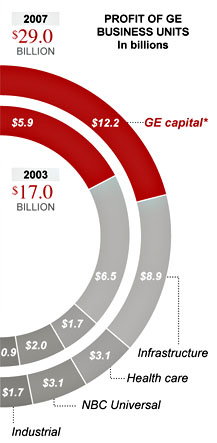

….GE Capital is the most instructive example in this category. The firm, a major subsidiary of the giant industrial conglomerate General Electric, is one of the largest U.S. shadow banks, and had more than $620 billion in assets at the end of 2007. Because of GE’s high-quality credit rating, GE Capital was able to satisfy most of its immense borrowing needs, during the bubble, in the capital markets. As the crisis developed, and capital market conditions tightened, GE leaned heavily on both Fed and FDIC emergency liquidity programs.

[Etc.]

Substantively, the Immelt appointment probably doesn’t matter much. But symbolically? It’s hard to imagine a much worse choice. Was Joseph Cassano not available or something?