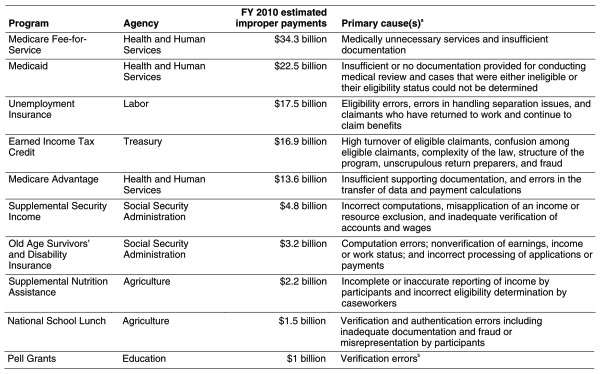

One of the problems with the GAO’s report on government inefficiency is that the vast bulk of it is just eye-glazing stuff. It’s all about coordinating this, doing better data collection on that, calculating ROI for something else, and performing better oversight on yet another thing. Yawn. What’s more, some of the most interesting big ticket items are already being addressed. Take improper payments. GAO estimates that the federal government pays out a whopping $125 billion per year that it shouldn’t. Here’s a chart:

There’s no question this is real money. But President Obama has already issued a series of orders aimed at reducing improper payments, and last year Congress passed the Improper Payments Elimination and Recovery Act, designed to “to enhance reporting and recouping of improper payments.” The goal is to reduce that $125 billion figure by $50 billion over the next two years.

So that’s already on the docket. Among other big ticket items that I’ve picked out of the report, tax expenditures are probably off the table because Republicans won’t vote for anything that Grover Norquist defines as a tax increase; ethanol subsidies are probably off the table because small farm states control the U.S. Senate; IRS efficiencies are probably off the table because Republicans don’t want the IRS to be more efficient at collecting taxes from rich people; and negotiating better prices for VA/DOD prescription drugs probably won’t go anywhere because Republicans are already on record as believing that it’s unfair for the U.S. government to reduce pharmaceutical industry profits.

There’s other stuff in the report that I haven’t gotten to yet. The entire Pentagon procurement section, for example. But aside from that, it’s mostly small-ticket stuff that depends on better reporting/coordination/oversight and might or might not produce any benefits. I’ll let you know if anything further catches my eye.