If we just left the tax code completely alone, a big chunk of our deficit problem would go away. This is not my preferred policy; I support allowing all the Bush tax cuts to expire, but allowing the Alternative Minimum Tax to blindly hit more and more families over the next couple of decades is a pretty blunt instrument for raising money. I think we can do better.

Still, it would solve a big piece of both our medium-term and long-term deficit problems. Ross Douthat, however, thinks this would be a catastrophe:

Today, for instance, a family of four making the median income — $94,900 — pays 15 percent in federal taxes. By 2035, under the C.B.O. projection, payroll and income taxes would claim 25 percent of that family’s paycheck. The marginal tax rate on labor income would rise from 29 percent to 38 percent. Federal tax revenue, which has averaged 18 percent of G.D.P. since World War II, would hit 23 percent by the 2030s and climb even higher after that.

Such unprecedented levels of taxation would throw up hurdles to entrepreneurship, family formation and upward mobility. (Or as the C.B.O. puts it, in its understated way, they would “tend to discourage some economic activity,” and “harm the economy through the impact on people’s decisions about how much to work and save.”)

There’s a lot of cherry picking going on here designed to make this look as oppressive as possible. For example:

-

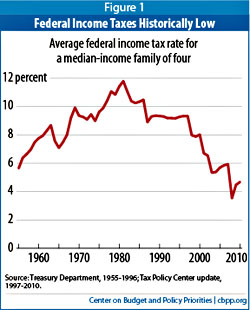

That 15% in federal taxes is mostly payroll taxes. Only about 3-4% is federal income taxes. That’s pretty low.

That 15% in federal taxes is mostly payroll taxes. Only about 3-4% is federal income taxes. That’s pretty low. - In fact, it’s historically low, as the CBPP chart on the right shows. Far from a higher level being “unprecedented,” a higher level would actually do nothing more than get us back to the average rates of the Reagan and Clinton eras.

- It’s true that federal tax revenue has averaged 18% of GDP since World War II. But why stop there? If you looked at average tax revenue since World War I it would look even lower and modern rates would look even worse. But this is a silly game. Average tax revenue over the past 30 years, a far more representative period, has been 21% of GDP.

- This means that if tax revenue goes up to 23% of GDP by 2030, it’s risen above its 30-year average by only two points. That’s hardly a catastrophe.

It’s easy to play games with this stuff to make it look like it’s the end of the world. That’s especially true if we resort to blunt comparisons, rather than constructing a tax code that actually makes sense. But we don’t have to do that.

The beginning of wisdom here is to accept that taxes are going up. The aughts were a nice holiday from history for us all, but they were an irresponsible one. America is aging, and that’s something we knew back in 2000 just as well as we know it now. Even if we do a good job of managing spiraling healthcare costs, this means that our obligations to retirees are going to go up. That’s not because of any insidious liberal plot, it’s just because there are going to be more of them.

So 21% of GDP isn’t going to cut it in the future. I doubt that 23% of GDP will cut it either. More likely, we’re looking at 25% of GDP or even a little more by the 2030s. But the fact is that this just isn’t that much. It’s four points of GDP above our post-Reagan average. We can afford that fairly easily, and if we reform the tax code with common sense in mind the impact will be pretty moderate on everyone. Middle class families will pay a little more in taxes, the upper middle class will pay a little bit more, and the rich, who have been showered with tax cuts over the past 30 years that really are unprecedented, will see theirs go up more than that. But the increase won’t be crushing for anyone.

I don’t question for a second that we need to do more to rein in spiraling healthcare costs. There’s just not enough evidence that we’re getting good value for money, and President Obama’s goal to keep future increases to GDP + 0.5% is a good one. But it needs to be more than just an aspiration, with seniors paying a crushing price in lost medical care if we don’t meet it — as they would under Paul Ryan’s flight of fancy. It needs to come with serious, detailed efforts to hold down costs and make sure we’re funding medicine that provides real benefits.

But even if we do that, we need to prepare for a world in which we pay upwards of 25% of GDP in taxes. That’s not the end of the American dream, as conservatives would have it, it’s a modest increase that ensures all of us a decently secure retirement. Letting the Bush tax cuts expire on both the middle class and the rich is a good place to start, and a smart reform of the tax code can pretty easily get us the rest of the way there over the next couple of decades without causing anyone very much pain. It’s time to grow up and face this reality.