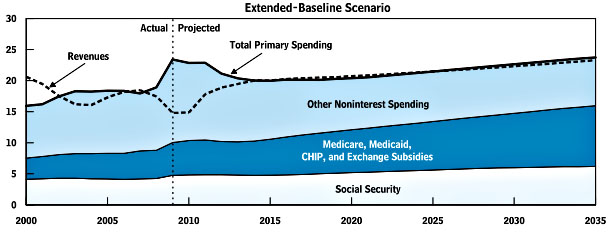

Speaking of fiscal reality, Austin Frakt reminds us that the federal budget, including Medicare, is actually in pretty good shape if we follow current law. Here’s the CBO’s projection of the primary budget (i.e., excluding interest payments):

Are Democrats willing to raise taxes in order to fund Medicare? Austin: “I do recall quite a vociferous debate over just this issue. Did Americans fail to notice that the health reform law spends a lot of money and includes a lot of tax increases? If so, that’s not just a Democratic messaging problem, but a Republican one too, and a general media failure. What more would it take to communicate this?”

Now, this CBO projection is one that assumes we follow current law. That is, we let the Bush tax cuts expire, we stop passing the doc fix, estate taxes revert to their 2009 levels, and we actually allow both the cost control mechanisms and tax increases of PPACA to take effect. As it happens, the estate tax has already been changed to rates slightly below the 2009 levels, but that has a pretty minor effect on things. The only one of these items that’s both significant and hard to imagine staying in place is the end of the doc fix. This means the budget isn’t quite as balanced as this chart suggests.

Still, even if we modify physician payments, we’re in decent shape as long as we have the discipline to let current law take its course, including both its tax increases and its cost controls. Toss in a compromise Social Security fix and we’d be in better long-term shape yet. So what’s wrong with this picture?

More detail here from Ezra Klein in word form rather than chart form.