<a href="http://www.flickr.com/photos/princesstheater/3530252342/">Princess Theater</a>/Flickr

I’m forced to defend my honor again on taxes. But I want to make this fairly brief. I don’t have a staff to run the numbers and I don’t have access to the details it would take to do a tax exercise with precision. But that probably doesn’t matter too much. Basically, I just want to put together a rough proof of concept showing how the kind of tax increases I have in mind to deal with the long-term deficit would (in my ideal world) hit the average family.

So here’s what I did. Basically, I took the deficit reductions in the Rivlin-Domenici plan and converted them into one-third spending cuts and two-thirds tax hikes. Then I figured those tax hikes as a percentage of national income, rather than a percentage of GDP, since we’re ultimately interested in how much of their income taxpayers will have to pay under my proposal. All of this jibed pretty well with the latest CBO report on the deficit, so I think the numbers are in the right ballpark. In fact, if anything I’m being more aggressive than I need to be.

So here’s the way I figure it. In the medium term, we need to let the Bush tax cuts expire, allow the Medicare cuts in ACA to take effect, and cut perhaps another $50-100 billion per year in spending. This will wipe out the primary deficit and then some.

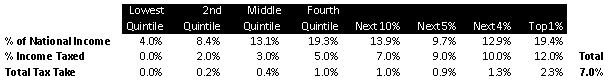

Then, between 2015 and 2030, we need to phase in tax increases that ultimately amount to about 7% of national income. The CBO has a nice table showing how national income is split up between different household income levels, so my task is to divvy up the tax increases so they add up to a total of 7%. Here’s how I did it:

The top row shows the share of national income from each quintile. The second row shows how much additional income they’d pay in taxes by the time my full tax hikes were phased in. The poorest don’t get hit at all. The 2nd quintile has to pay an additional 2% of their income in taxes. The middle quintile pays an additional 3% of their income. All the way to the top 1%, who pay an additional 12% of their income. All of this adds up to 7% of total national income.

Remember, this is only the tax half of the deficit plan. To make the numbers come out, you’d also need spending cuts amounting to about half of the tax increases. Beyond that, a couple of comments:

- Conservatives will be aghast that I’m raising the effective tax rate on the richest 1% by 12 percentage points. But the rich have had a helluva ride over the past 30 years: their incomes have skyrocketed and their tax rates have gone down. Now the holiday from history is over. Sorry guys. And since I don’t belong to a religion that pretends that higher tax rates on the rich will inevitably produce economic catastrophe, I’m free to simply allocate taxes in a way that’s fair and equitable.

- I’m making no assumptions about how we change the tax code to accomplish this. It might be a combination of income tax rate hikes, payroll taxes, carbon taxes, estate taxes, reductions in tax expenditures, consumption taxes, or anything else. All I’m saying is that after you figure out the incidence of whatever taxes you raise to get to 7% of national income, this is how I’d like to see it distributed.

- As I suggested before, half the country would pay no more than an additional 3% of their income in taxes, and 80% of the country would pay no more than an additional 5% of their income. And this would be phased in gradually over the course of fifteen years. It’s not pain free by any means, but it’s not the end of the world either.

No one should take this too seriously. It’s not a real proposal, the numbers are back-of-the-envelope, and trying to make plans on a 20-year horizon is a mug’s game anyway. However, it does show that if we rein in the deficit with a 2:1 ratio of tax hikes to spending cuts, the tax increases can still be quite manageable.

The alternative, of course, is some pretty savage cuts in Medicare, Medicaid, and Social Security. If conservatives think they can sell this to the public as an alternative to tax increases like mine, more power to them. But I don’t think they can. The public, bless their black little hearts, doesn’t want program cuts or tax increases, but when they’re finally forced to make a decision, as they will be, I think they’re more likely to accept tax increases like mine paired with modest program cuts, rather than small (or no) tax increases paired with big cuts. We’ll see eventually, I guess.