Big news today! The Congressional Budget Office has gotten into the infographic business. I’m pretty sure they’ve done this just as infographics are going out of fashion, but still. It’s a nice effort to maintain the attention of the internet generation.

Today’s infographic is about the infamous “fiscal cliff.” Basically, a whole bunch of stuff is set to expire on December 31st. The Bush tax cuts will go away, raising taxes by hundreds of billions of dollars. Big spending cuts agreed to as part of the debt ceiling standoff will take effect. The payroll tax holiday enacted during the 2010 lame duck session will expire. Unemployment benefits will get slashed. Medicare payment reductions will go into effect. And those are just the big ticket items.

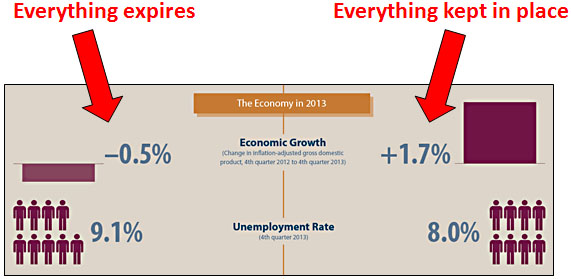

So what effect would this have on the economy? Here’s a snippet from the infographic:

That’s pretty bad. If we extend everything, CBO figures economic growth will clock in at about 1.7% next year — not great, but not catastrophic either. But if everything expires, the country will fall back into recession, with the economy shrinking by 0.5%.

It’s vanishingly unlikely that Congress will even attempt to address this before the election. That means we’re due for yet another exciting lame duck session in December. I’ll bet you can hardly wait.