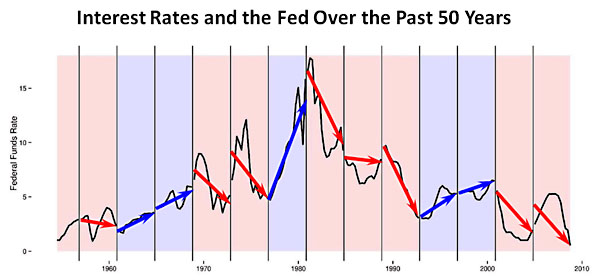

Republicans may have taken to hating the Fed in recent years, but University of Michigan political scientist William Clark tells us today that the Fed sure loves Republicans. In every single presidential term over the last five decades, interest rates have risen between the beginning and end of Democratic administrations and dropped during Republican administrations:

This is actually even more sinister than it looks. Clark says that, even after controlling for macroeconomic conditions, it appears that “as elections draw near, the Fed adopts a looser monetary policy when Republicans control the White House.” In this, he’s echoing Jamie Galbraith, who wrote a paper in 2007 showing exactly the same thing. In fact, he demonstrated that the Fed systematically intervenes during election years, but in opposite directions depending on which party holds the White House. Controlling for economic conditions, the Fed loosens more than expected when Republicans are seeking reelection and tightens more than expected when a Democrat is seeking reelection.

Of course, this might all just be a big coincidence. I report, you decide.

POSTSCRIPT: Fairness dictates that I acknowledge Ben Bernanke as the exception to this rule. He couldn’t actually lower interest rates for Barack Obama, since rates were already near zero when he took office, but Bernanke has certainly engaged in several rounds of nontraditional monetary easing during Obama’s term.

Of course, fairness also requires me to acknowledge that Republicans have screamed blue murder about this every step of the way, because they’re bound and determined to oppose anything that might help the economy during a Democratic administration.