Earlier today I promised you that an analysis of Mitt Romney’s tax plan from last night would be a lot easier than an analysis of his earlier plan. As you recall, Romney’s previous proposal was to cut rates 20% across the board and eliminate deductions to make up for it. This means you have to model all the various deductions currently in the tax code and figure out how much each one is worth. Then you get into endless arguments about whether your model is right, which deductions are “on the table,” etc. etc. In the end, it’s your study vs. my study and may the best man win.

Romney’s new plan slices through this Gordian knot by simply capping the total level of deductions at $25,000. It doesn’t matter which deductions you take or how much they’re worth. You just assume a $25,000 cap and you’re done. No details needed. Easy peasy.

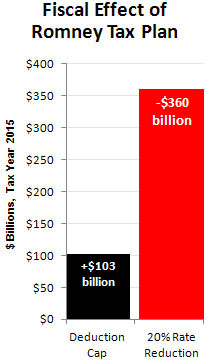

So here it is, the world’s simplest tax analysis. Based on studies from the Tax Policy Center (rate cuts here, deductions here), it’s an estimate of the effect of Romney’s plan on tax revenue in the year 2015:

So here it is, the world’s simplest tax analysis. Based on studies from the Tax Policy Center (rate cuts here, deductions here), it’s an estimate of the effect of Romney’s plan on tax revenue in the year 2015:

- Tax loss from the 20% rate cut: $360 billion

- Tax increase from the $25,000 deduction cap: $103 billion

Is this still too complicated? The colorful graph on the right should make everything clear. Romney is $257 billion short, and the rest of his plan (eliminating the estate tax, eliminating investment taxes for middle-income earners, lowering the corporate tax rate) just makes things even worse. One way or another, Romney has a whole slug of revenue he needs to make up. His plan just doesn’t add up.