The Congressional Budget Office has scored the Senate’s immigration reform bill, and the news is pretty good for deficit hawks. According to CBO estimates, the bill would:

Increase federal direct spending by $262 billion over the 2014–2023 period. Most of those outlays would be for increases in refundable tax credits stemming from the larger U.S. population under the bill and in spending on health care programs….

Increase federal direct spending by $262 billion over the 2014–2023 period. Most of those outlays would be for increases in refundable tax credits stemming from the larger U.S. population under the bill and in spending on health care programs….- Increase federal revenues by $459 billion over the 2014–2023 period. That increase would stem largely from additional collections of income and payroll taxes….

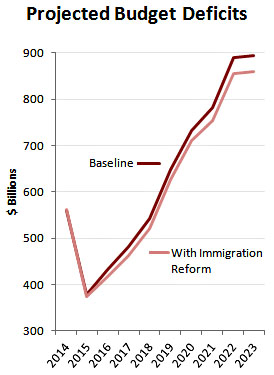

- Decrease federal budget deficits through the changes in direct spending and revenues just discussed by $197 billion over the 2014–2023 period.

Compared to its baseline estimates, CBO also projects that if the immigration bill is passed, GDP will increase a bit over the next decade; wages will go down a bit but then rise in the decade after that; capital investment will rise; and the productivity of labor and of capital will go up. All of these effects are fairly small, however. Economically, a pretty reasonable takeaway is that immigration reform would probably have a positive effect, but not a large one.