With the start of open enrollment in Obamacare a week away, HHS today released a report summarizing the cost of premiums in states where the exchanges will be run by the federal government. In general, the news was pretty good. As with most of the state exchanges, the premiums are coming in below the predictions of the Congressional Budget Office:

Individuals will have an average of 53 qualified health plan choices in states where HHS will fully or partially run the Marketplace.

…Premiums before tax credits will be more than 16 percent lower than projected. The weighted average second lowest cost silver plan for 48 states (including DC) is 16 percent below projections based on the ASPE-derived Congressional Budget Office premiums.

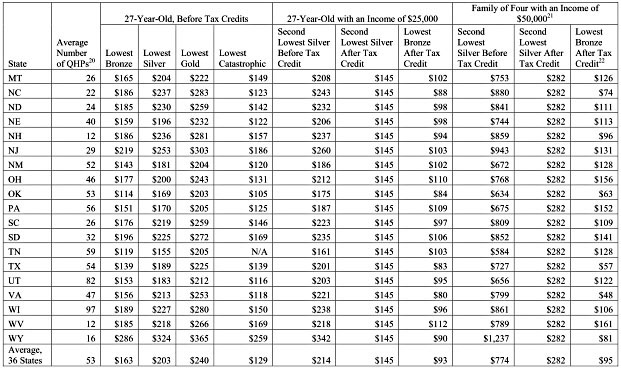

…Tax credits will make premiums even more affordable for individuals and families. For example, in Texas, an average 27-year-old with income of $25,000 could pay $145 per month for the second lowest cost silver plan, $133 for the lowest cost silver plan, and $83 for the lowest cost bronze plan after tax credits. For a family of four in Texas with income of $50,000, they could pay $282 per month for the second lowest cost silver plan, $239 for the lowest silver plan, and $57 per month for the lowest bronze plan after tax credits.

I don’t suppose Ted Cruz will be mentioning any of this in his speechifying on the Senate floor tonight. But it’s worth taking a look at those numbers. After tax credits, that family of four in Texas will pay $3,384 per year for the second-lowest-cost silver plan. According to the Kaiser Family Foundation, the average family with employer health coverage pays $4,565 per year in contributions. Those aren’t directly comparable, but they’re close. What it means is that although Obamacare is hardly free, it does allow individuals to buy coverage for roughly the same amount they’d have to pay with an employer plan. No one is shut out of the market any longer.

The entire report is here. An excerpt of one of the tables is below, showing how much coverage will cost for individuals and families in various states.