Credit where it’s due department: I was pretty skeptical of Dave Camp’s tax reform proposal last night, figuring that it would just be the usual Republican mush of lower tax rates on the rich combined with some handwaving about elimination of tax breaks  that would theoretically make it revenue neutral.

that would theoretically make it revenue neutral.

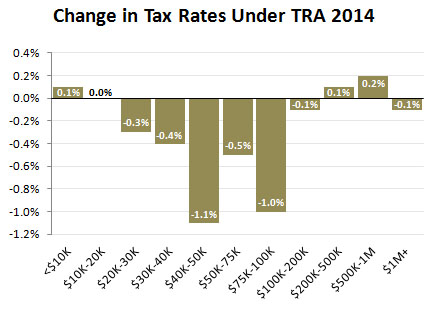

But I was wrong. It turns out that Camp’s plan specifies the tax breaks he wants to close in considerable detail. And according to the analysis of the Joint Committee on Taxation, which is usually fairly reliable, it would be both revenue neutral and distributionally pretty neutral too. Over ten years it would raise about $3 billion more than present law, and the chart on the right shows how tax rates would be affected. Generally speaking, effective tax rates would go down for the poor and the middle class, and would go up a bit for the affluent. (These are estimates for 2015. They change slightly in subsequent years.)

Needless to say, this all depends on his plan being passed as is, which isn’t likely. In fact, it seems unlikely to pass at all. Nonetheless, Camp’s plan isn’t just a Trojan Horse to cut taxes on the rich. There are, unsurprisingly, aspects of it I don’t like, but it seems to be a tolerably serious effort at tax reform that both parties could live with. It’s certainly a lot better than I expected.

UPDATE: On the other hand, Jared Bernstein says there’s a little too much smoke and mirrors in Camp’s plan:

The real problem is on the revenue side. There are far too many timing gimmicks that temporarily increase tax revenues in the scoring window (the first 10 years) to create the impression of lasting revenue neutrality and positive economic incentives. But once these gimmicks expire, the plan will collect significantly less revenue, leading to all kinds of headaches for both deficits and growth.

More details at the link.