Keith Humphreys notes that economic growth over the past year has been similar in Britain and the United States even though the two countries adopted very different responses to the Great Recession:

But don’t expect the similar levels of growth in the two countries to shake many people’s faith in their economic views. Most of the “slim government” crowd will argue that Britain didn’t cut enough (or that the U.S. growth isn’t real) and that’s why the U.K. hasn’t left the U.S. in the dust. Most increased government spending supporters will see proof that the stimulus wasn’t big enough (or that the U.K. growth isn’t real) because if it had been U.S. growth would be dwarfing that of the sceptred isle.

Many people seem to have stable preferences about whether they want government bigger or smaller. They will point to current economic conditions as the reason for why their preferences should prevail, but their preferences do not change when those putatively justifying economic conditions fade away. Neither are most people fazed when the government spending policies they support (as well as those that they oppose) deliver different results than they expected. Motivated reason is such a force in this particular policy area that rather than arguing over what current economic conditions particularly require, debaters are probably

better off cutting to the chase and arguing directly about the real issue: Disagreement about how big or small we want the government to be.

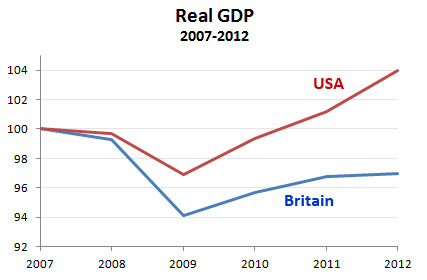

I don’t think this is fair. If you want to compare Britain and the US, you have to look at their entire growth trajectory since the start of the recession. The chart on the right is taken from OECD numbers, so it’s an apples-to-apples comparison. And really, there is no comparison. As of 2012 (the most recent figures available from the OECD) Britain’s GDP was still 3 percent below its 2007 level. By contrast, US GDP was 4 percent above its 2007 level.

We can argue all day long about what caused this divergence, but I think the raw data is fairly unequivocal. Whatever the reason, the US economy really did suffer less and recover more robustly than the British economy.