Because I’m a glutton for punishment, I decided to read Marco Rubio’s plan for rescuing Social Security. According to Rubio, “The startling truth is that with an aging population, a sluggish economy, and chronic fiscal irresponsibility in Washington, the Social Security trust fund is drying up. It will be insolvent by 2033….Taken together, these factors have created a real and looming crisis….Anyone who is in favor of doing nothing about Social Security and Medicare is in favor of bankrupting Social Security and Medicare.”

I don’t want to bankrupt Social Security, so let’s read Rubio’s plan. It contains a grand total of four policy proposals:

- Allow workers to invest money in the federal Thrift Savings Plan.

- Eliminate the payroll tax for anyone over age 65 who continues to work.

- Raise the Social Security retirement age for those under the age of 55.

- Increase benefits for low-income seniors and reduce scheduled benefit increases for rich seniors.

Item #1 may or may not be a good idea, but it has no impact on Social Security. Item #2 reduces payroll tax income and therefore makes Social Security less solvent. The first half of item #4 increases benefits and also makes Social Security less solvent. Item #3 and the second half of item #4 would improve the solvency of Social Security.

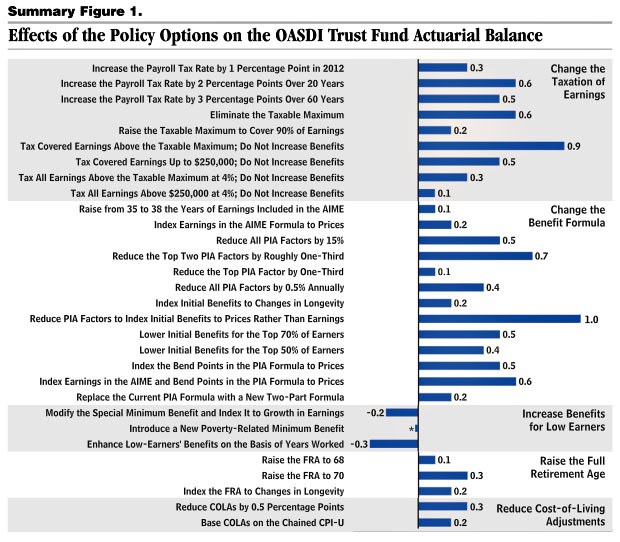

So would this rescue Social Security? Do Rubio’s numbers add up? That’s hard to say since his proposal is pretty vague, but let’s take a shot at figuring it out. A few years ago the CBO scored a bunch of  proposed changes to Social Security, and with a bit of judicious guessing and extrapolating we can match them up with Rubio’s proposals. Here’s my best estimate:

proposed changes to Social Security, and with a bit of judicious guessing and extrapolating we can match them up with Rubio’s proposals. Here’s my best estimate:

- Item #2: According to my back-of-the-envelope calculation, about 5 percent of all workers are over the age of 65. Eliminating the payroll tax they pay would therefore reduce payments into the system by roughly 5 percent. This is about the equivalent of reducing the payroll tax rate by 0.6 percentage points, and would therefore worsen Social Security’s actuarial balance by about 0.2 percent of GDP.

- Item #3: This one is easy. CBO says that raising the retirement age to 70 would improve Social Security’s actuarial balance by 0.3 percent of GDP.

- Item #4.1: It’s hard to figure this out without any details about what Rubio has in mind, but the CBO proposal that fits the closest would worsen Social Security’s actuarial balance by about 0.2 percent of GDP.

- Item #4.2: Again, it’s hard to say without details, but if you reduce the growth rate of benefits for everyone (by indexing them to prices instead of earnings), it improves Social Security’s actuarial balance by 1.0 percent of GDP. If you did this for the richest quarter of retirees, it would improve Social Security’s actuarial balance by, oh, let’s say 0.4 percent of GDP.

So let’s add this all up: -0.2 + 0.3 – 0.2 + 0.4 = 0.3 percent of GDP. Unfortunately, CBO currently estimates that Social Security needs to improve its actuarial balance by about 1.17 percent of GDP. Rubio’s plan comes nowhere near that.

Needless to say, this is all a little fuzzy. CBO may be unduly pessimistic. Rubio may be planning to raise the retirement age to 75. Maybe his promises to raise payments to the poor are just hot air. Maybe my seat-of-the-pants estimates are off.

But none of this really matters. Different calculations might change things on the margin, but they wouldn’t even come close to making Social Security solvent by conventional measurements—and those are the measurements Rubio is using. As usual with these kinds of proposals from conservative presidential aspirants, the math just doesn’t add up. I am shocked.