Mother Jones

For Americans who like to eat out occasionally, the full-service restaurant industry is full of relatively affordable options—think Olive Garden, Applebees, or Chili’s. But these spots aren’t exactly a bargain once a hefty hidden cost is factored in: The amount of taxpayer assistance that goes to workers earning little pay.

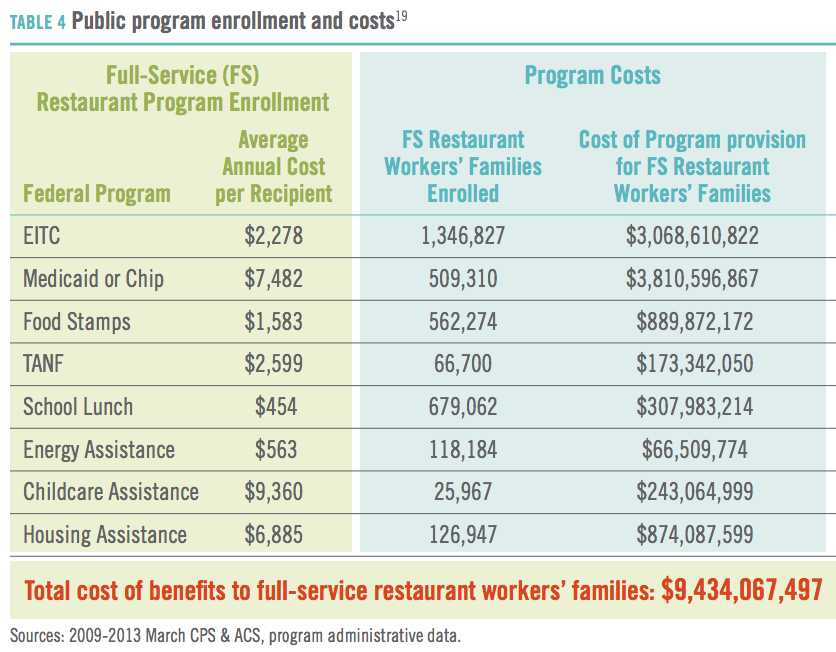

Food service workers have more than twice the poverty rate of the overall workforce, and thus more often seek out public benefits. A new report published last week by the Restaurant Opportunities Centers United (ROC), a restaurant workers’ advocacy and assistance group, calculated the tab and found that from 2009 to 2013, regular Americans subsidized the industry’s low wages with nearly $9.5 billion in tax money each year. That number includes spending from roughly 10 different assistance programs, including Medicaid, food stamps, and low-income housing programs like Section 8.

Here’s the breakdown per program:

The amounts were calculated by combining Census and Bureau of Labor Statistics figures on the programs’ cost and enrollments with the number of Americans working in full-service restaurants.

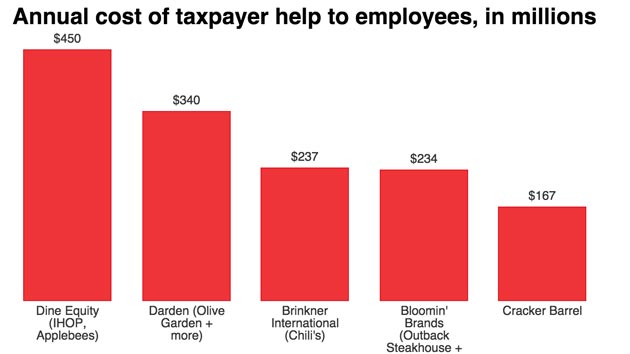

ROC also found that employees at the five largest full-service restaurant companies alone cost taxpayers about $1.4 billion per year. According to the report, these five companies employ more than half a million of the sector’s more than 4 million workers.

Here’s another striking statistic: If you add up these five companies’ profits, CEO pay, distributed dividends, and stock buy-backs, the total comes to a bit more than $1.48 billion—almost exactly what taxpayers spend on these five companies’ workers, $1.42 billion.

ROC’s report notes another key point: Polling shows that most Americans want a tax system that requires Corporate America to pull its weight. If customers start realizing that their meal costs a lot more than the check says, they just might lose their appetite.