Last week produced a weak jobs report, and today Fed chair Janet Yellen implied that this made an interest rate hike unlikely in the next month or two. Fine. But that’s just one report over one  month. Does it really tell us much about the health of the labor market?

month. Does it really tell us much about the health of the labor market?

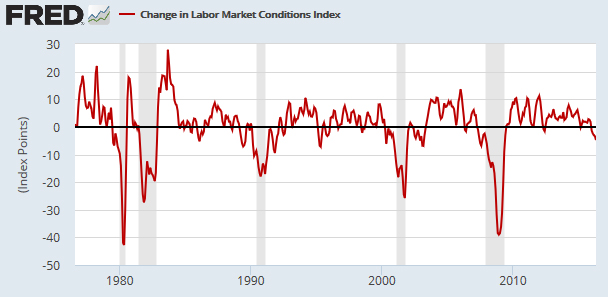

Maybe not. Justin Fox suggests that “things have actually been on the downswing for the U.S. labor market for months,” based on his read of a newish composite measure from the Fed called the Labor Market Conditions Index. As you can see on the right, the LMCI has mostly shown positive growth over the past three years. In fact, it’s been positive since mid-2009. But growth turned negative in January and has been getting steadily more negative ever since. It’s currently at -4.8.

So that’s not so great. But because the LMCI is a composite mishmash of other metrics, it’s hard to have any kind of intuitive sense of what it means. Is -4.8 bad? Really bad? Just a blip?

One way to get a better sense of LMCI is to take a longer-term look at it. The Fed boffins have back-calculated it to 1976, so here it is for the past 40 years:

Ah. It’s one of those measures designed to predict recessions. As its creators say: “Changes in the LMCI align well with business cycles as defined by the National Bureau of Economic Research….[Since 1980] the LMCI has fallen about an average of 20 points per month during a recession and risen about 4 points per month during an expansion.”

These kinds of composite measures are a dime a dozen. Constructing them is practically a parlor game among a certain kind of economist. They’re also problematic. LMCI, for example, combines 19 separate measures, and with that many inputs it’s not hard at all to gin up a formula that will pretty accurately match past history. So I’d take LMCI with a grain of salt until we see how it does at predicting the next recession.

That said, if we do take LMCI seriously the question is: how low can it go before a recession is inevitable? Answer: Over the past 40 years, it’s never gotten below -10 without foreshadowing a recession. In fact, during normal periods of expansion, it’s never gotten below -7 without turning into a recession.

So: If we assume that LMCI has predictive capability, we can say that if it keeps dropping for another few months it probably means bad news. And if it drops into negative double digits, a recession is almost inevitable. That’s a lot of ifs and probablies, but possibly something to keep an eye on anyway.