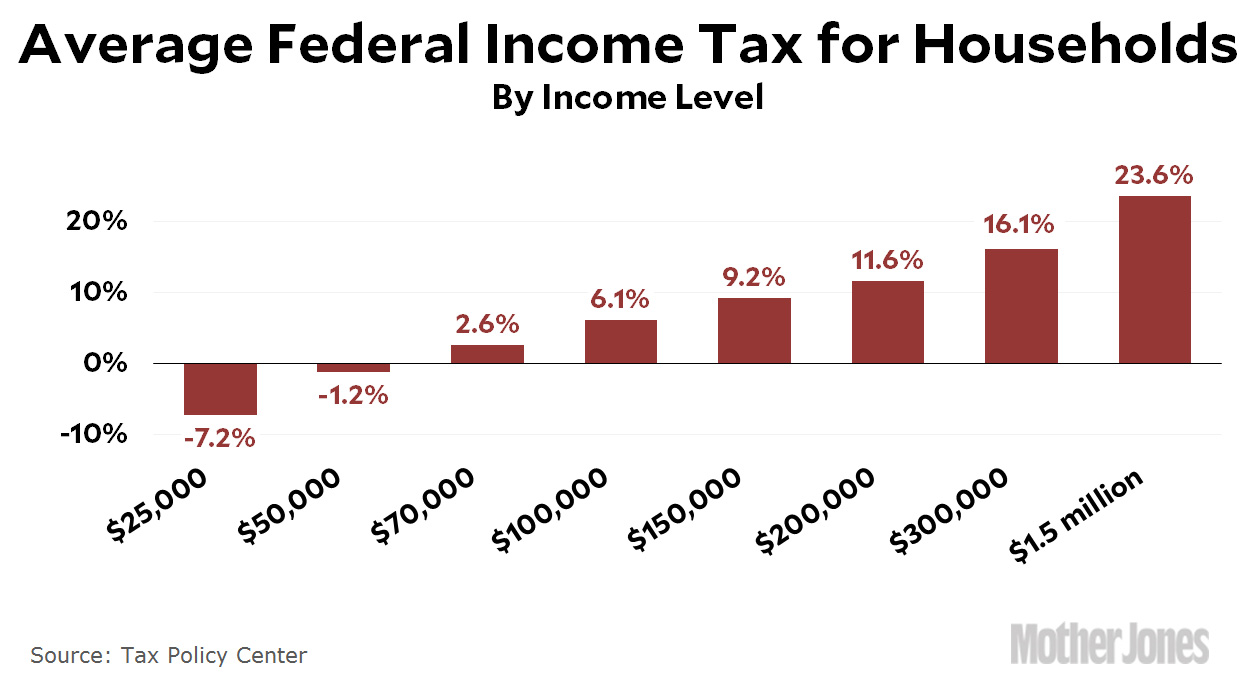

When Paul Ryan says he wants “tax reform,” what he means is that he wants to cut taxes on the rich. That means top marginal rates, capital gains rates, dividend rates, and estate tax rates. Primarily this is because Republicans have few economic goals left on earth except cutting income taxes on corporations and the rich. Here’s one reason why:

Basically, there’s no income tax to cut anymore until you get to household incomes in the six figures. Even at $200,000, the federal income tax rate is pretty modest. So if you’re going to cut income taxes, it’s pretty hard to cut them very much for anyone but the rich.

Of course, households with lower incomes still pay a lot in payroll taxes, state sales taxes, and other flat or regressive taxes. The federal income tax is the main bulwark that makes the overall tax system progressive, so it’s easy to see why Republicans hate it.