The Associated Press reports today on various rumors making the rounds about President Trump’s tax plan, including this one:

One circulating this past week would change the House Republican plan to eliminate much of the payroll tax and cut corporate tax rates. This would require a new dedicated funding source for Social Security….This approach would give a worker earning $60,000 a year an additional $3,720 in take-home pay, a possible win that lawmakers could highlight back in their districts….Although some billed this as a bipartisan solution, and President Barack Obama did temporarily cut the payroll tax after the Great Recession, others note it probably would run into firm opposition from Democrats who loathe to be seen as undermining Social Security.

Just to be clear: this is pie in the sky, not something that has any real chance of happening. Still, let’s go along with the gag. If you wanted my vote for this in return for whatever horrible thing Republicans wanted to do with the rest of the tax code, the easiest way to get it would be to not create a new dedicated funding source for Social Security. Just put the trust fund bonds in a big ol’ bonfire and pay for Social Security out of the general fund. This is how we pay for nearly everything else, after all.

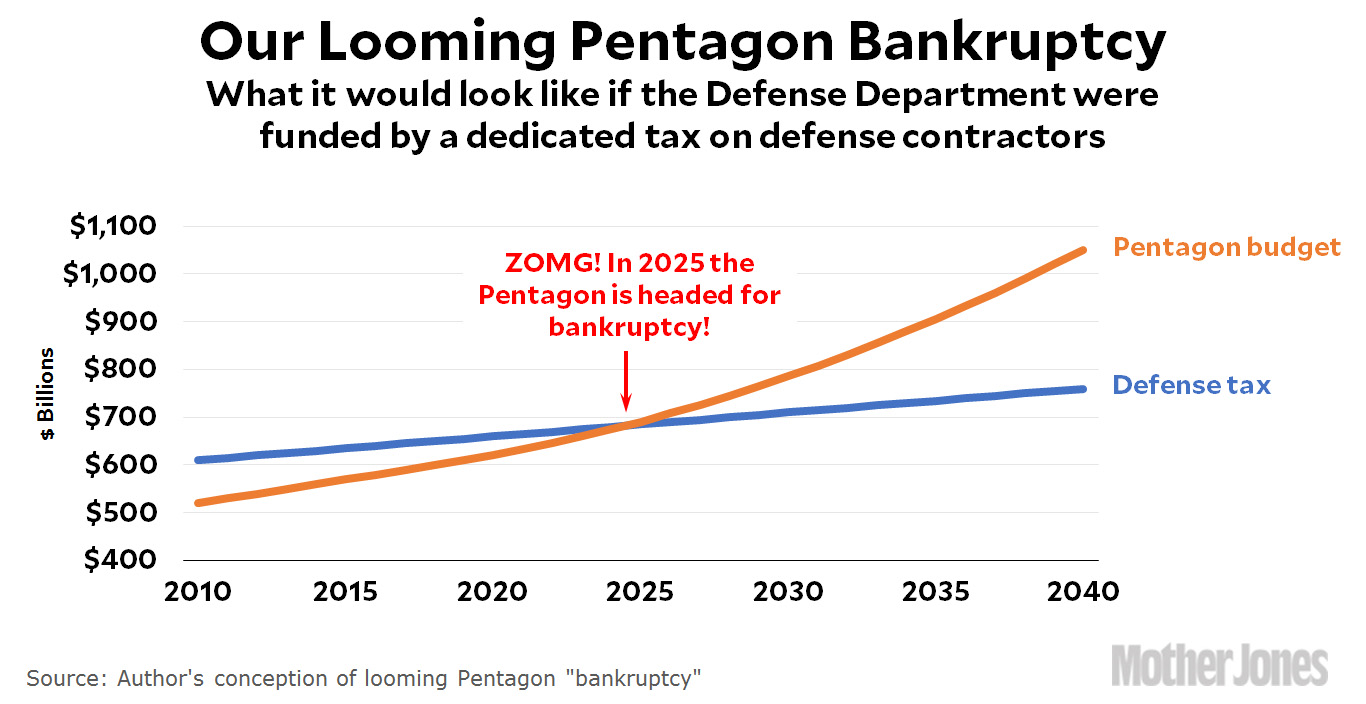

If we did this, we could do away with the annual idiocy about Social Security “going bankrupt,” which makes about as much sense as the Pentagon going bankrupt. The only reason we say this about Social Security is because it’s possible to compare Social Security costs with a specific funding stream. But who cares? Money is money, and if we spend too much it turns into a deficit, regardless of where the money is coming from.

Neither Social Security nor the Pentagon will go bankrupt unless Congress allows it, and Congress will never allow it. So why maintain the charade? Get rid of the regressive dedicated funding stream, fund Social Security from general revenues, and then adjust taxes and/or deficits as necessary to pay for it. This seems to work tolerably well for every other function of government, so why not Social Security?

Now, about Medicare….