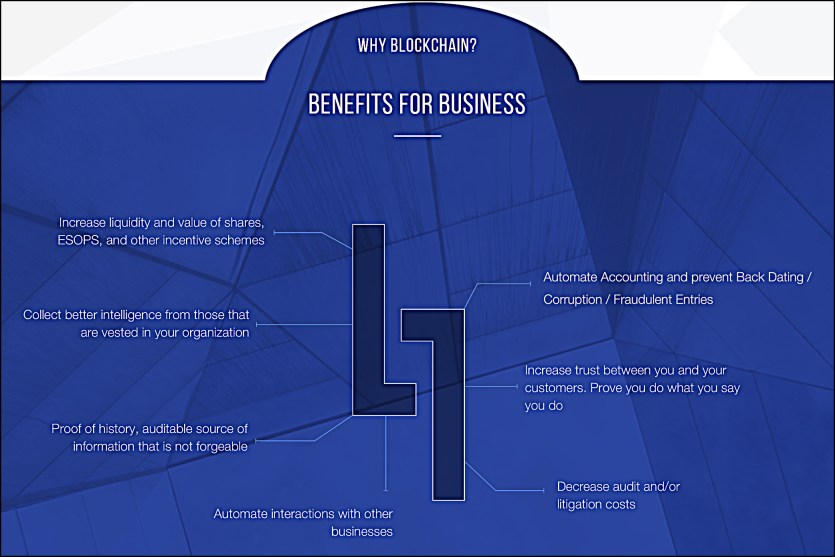

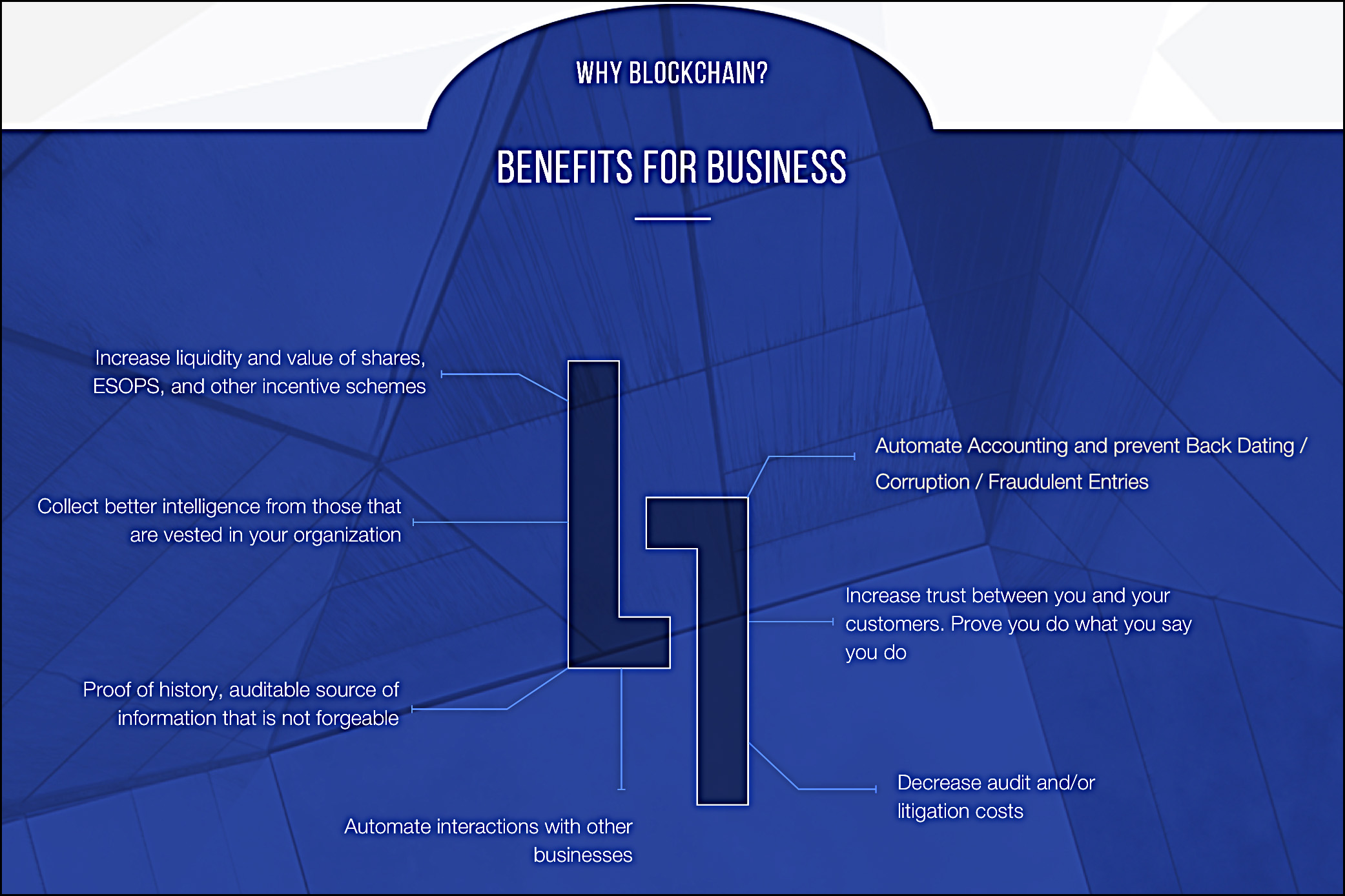

I am, obviously, out of touch with the bold new world of cryptocurrencies. According to the Wall Street Journal today, the biggest initial coin offering of the year is for EOS, which, it turns out, is not a coin at all. It’s not clear if EOS is even a product. Rather, it’s the open-source brainchild of block.one, which says that it “provides end-to-end solutions to bring businesses onto the blockchain from strategic planning to product deployment.” Here’s the elevator pitch:

Whatever. But back to EOS. What is it? Answer: it is an “operating system-like construct.” Will block.one be selling EOS? Answer: no, it will be released under an open source software license. After that, third parties can go to town on it. And what does EOS stand for? Answer: “We believe that EOS means different things to different people. We have received numerous amazing interpretations of what EOS stands for or what it should stand for so we have decided not to formally define it ourselves.”

So far this sounds like a parody. But it’s perfectly real, and it’s funded not by normal venture capital or anything else that gives investors any rights, but by the daily sale of tokens that are, explicitly, worthless: “The EOS Tokens do not have any rights, uses, purpose, attributes, functionalities or features, express or implied, including, without limitation, any uses, purpose, attributes, functionalities or features on the EOS Platform.” And just in case this disclaimer isn’t enough, you can’t buy them in the United States and block.one itself is registered in the Cayman Islands. Why take chances?

The Journal says block.one has raised $700 million this year and has a market cap of $4.5 billion. What they don’t say is that this is actually a market cap of 6.3 million Ethereum, which is allegedly worth about $4.5 billion. No actual dollars or yen or euros have changed hands here. So to summarize:

- block.one will not be selling its primary product. In fact, it’s not really clear exactly what they will be selling.

- EOS tokens provide neither an ownership share in block.one nor any claim on its earnings.

- EOS tokens are layered on top of Ethereum, a cryptocurrency that may or may not have any actual intrinsic value.

Even in the heyday of pre-crash CDOs and synthetic CDOs and all their demon spawn, derivatives all had at least a notional connection to a real income stream of some kind. But EOS appears to be valueless all the way down. If this isn’t the behavior of a bubble, I don’t know what is.