I don’t understand stuff like this. Here is Nomi Prins:

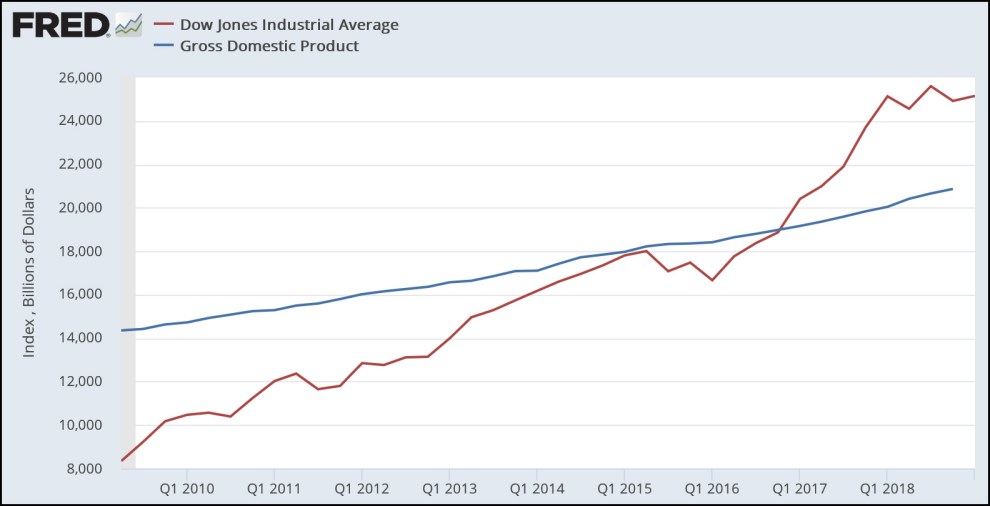

For literally anybody that thinks the Fed’s low rate / QE policy since the financial crisis actually impacts real economic growth as opposed to the stock market’s growth, just look at this picture – from the Fed’s own data base. pic.twitter.com/ZBl9B63DSl

— Nomi Prins (@nomiprins) March 22, 2019

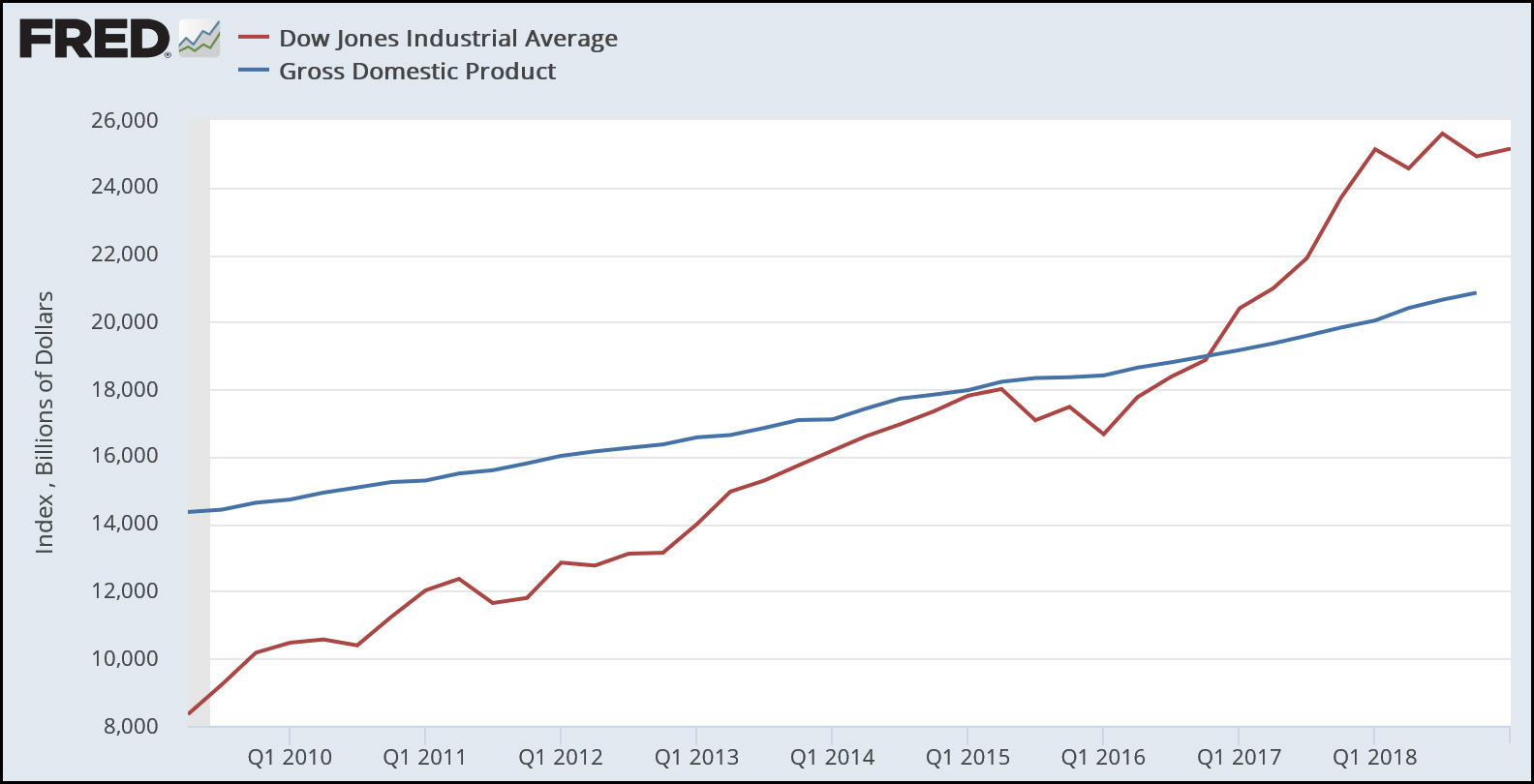

Yes, this is from FRED, which is run by the St. Louis Fed. But the Dow Jones line shows a raw number, uncorrected for inflation. The GDP number shows growth since the previous quarter, and is corrected for inflation. You can’t compare these. Here’s a proper comparison:

As you can see, this chart still shows that the stock market has grown a lot faster than GDP since the end of the Great Recession. So why not use it? I can only think of two possibilities: (a) Prins doesn’t understand that her comparison is meaningless, or (b) she understands but doesn’t care. Whichever one it was, she thought highly enough of her chart to retweet it today.

Beyond that, I have no idea what her point is. Does she think that higher interest rates following the Great Recession would have been good for us working stiffs? It’s true that the stock market has grown faster than GDP over the past eight years, and that’s generally not such a great thing since equity growth mostly benefits the rich while GDP growth helps rich and poor alike. However, that doesn’t really say anything about Fed policy, which is a fairly blunt instrument that can’t be tuned to affect GDP but not the stock market.

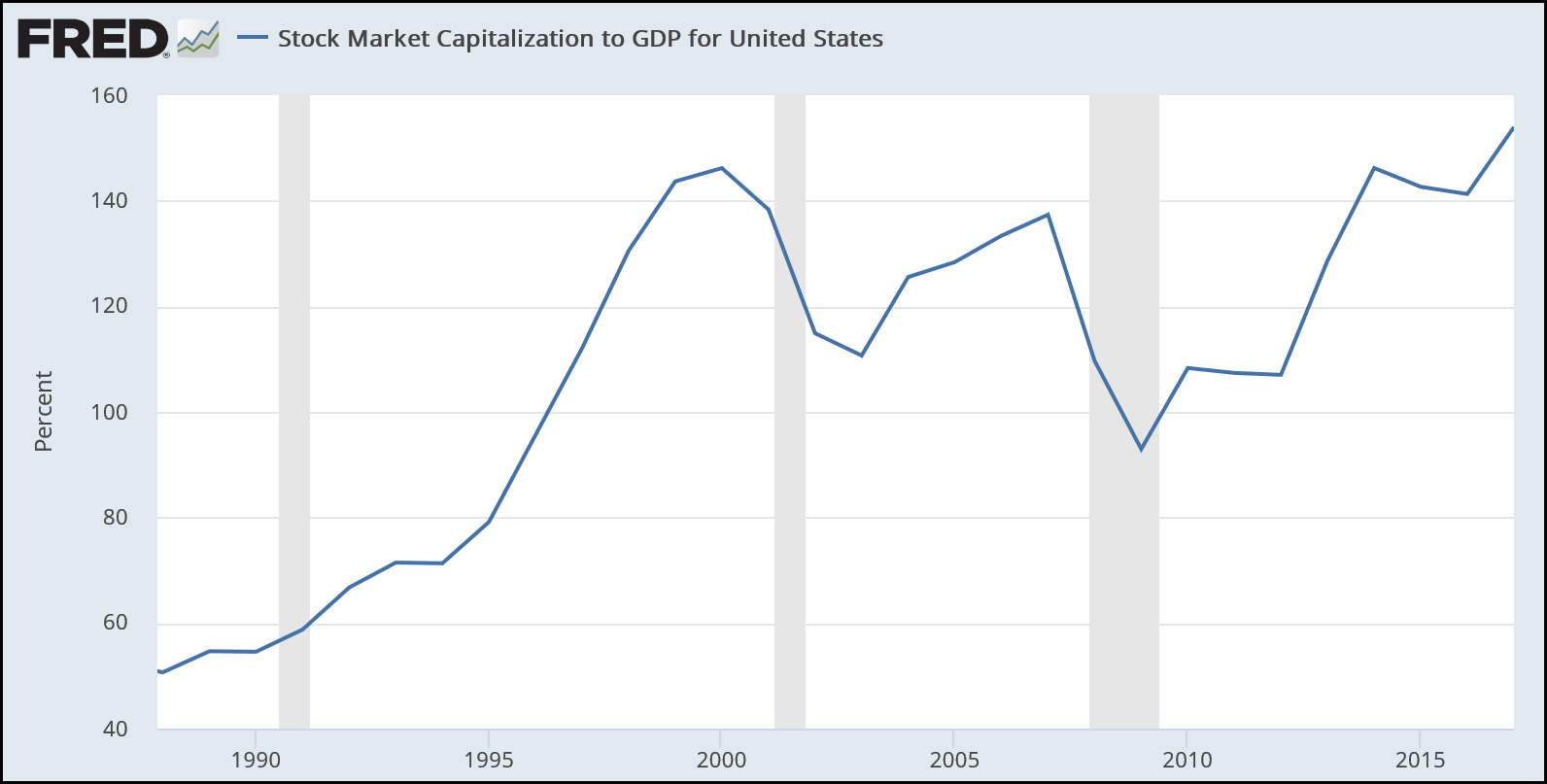

In any case, you might be interested in a better measure of how much wealth is tied up in the stock market and how it’s performed over the past few decades:

This accounts for all stocks, not just those in the Dow Jones average, and it shows total value as a percent of GDP. Once again, growth has been strong since 2010, but that’s after a steep drop during the Great Recession. We’re now only a bit higher than previous peaks. Like Prins, I’d like to see a more egalitarian economy, and I wish the Fed were more willing to keep interest rates low until we truly see the whites of inflation’s eyes. That said, there’s nothing all that spectacular to see here.