A couple of days ago I wrote about “the myth of the urban millennial.” More generally, I’ve also been making the case that millennials are pretty similar to past generations, and part of that similarity has to do with their preference of where to live. But how do I know what their real preference is? Maybe lots of them want to live in big cities and the only reason they don’t is because of a housing shortage that’s driven up prices. A Twitter reader asks a reasonable question:

What data/evidence would you expect to see if in fact millennials did prefer urban housing, but were being forced to the suburbs by cost and/or the failure of the urban housing stock to keep pace with population growth?

— Chris Garrett (@cjg2127) July 3, 2019

The answer here comes mostly from survey data: if there were a big mismatch, you’d expect to find lots of millennials who don’t live in cities but say they want to. However, that’s not what you find. Here are several examples, all for 18-29 year-olds:

- In a 2011 survey by the National Association of Realtors, 33 percent of millennials lived in cities but only 31 percent wanted to. Conversely, 40 percent lived in suburbs but 42 percent wanted to.

- In a 2014 survey by Fannie Mae, 90 percent of millennial renters said they would eventually buy a home.

- In a 2015 survey by the National Association of Home Builders, two-thirds of millennials said they would prefer to buy a home in a suburb, while only 10% wanted a home in the center of a city.

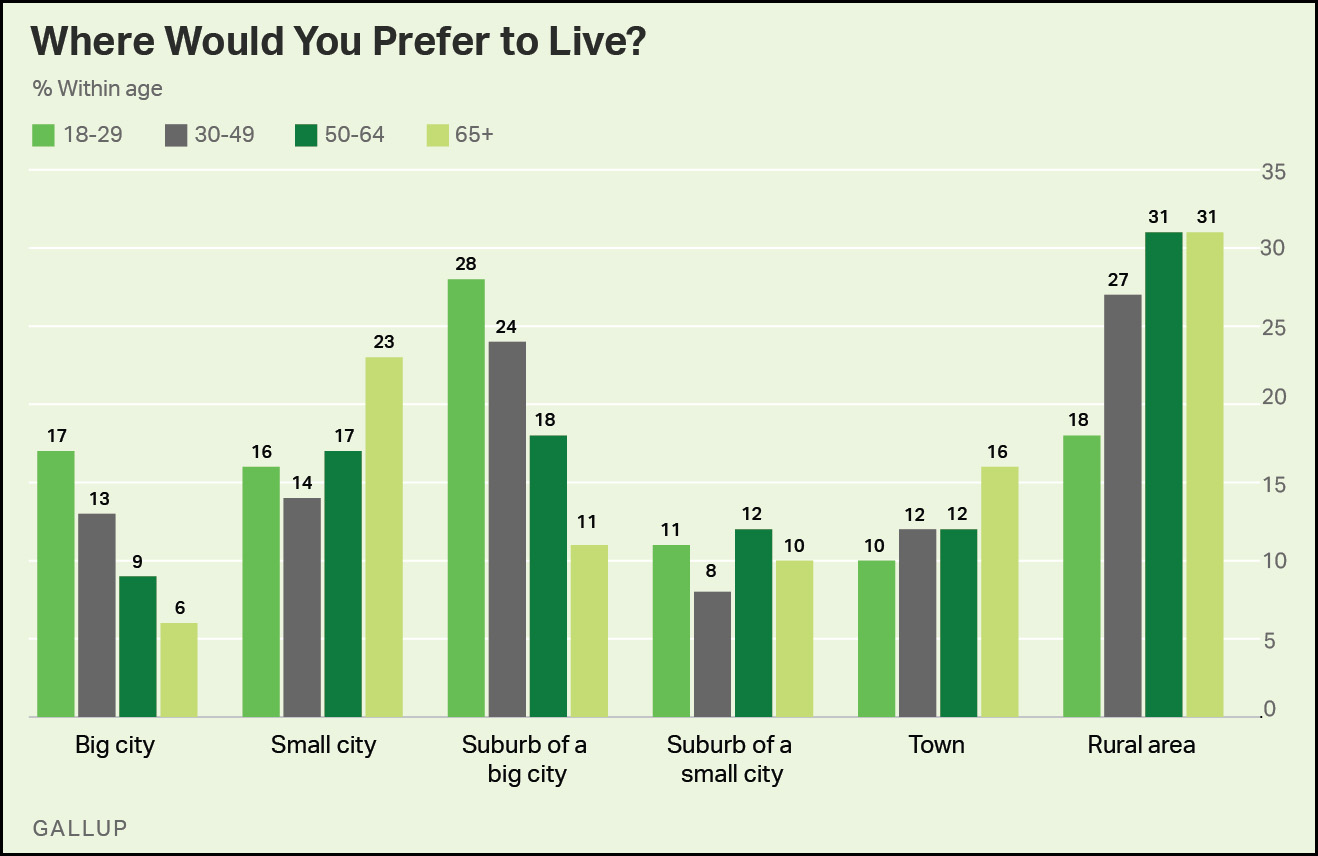

- In a 2018 survey from Gallup, 29 percent of millennials lived in big cities but only 17 percent wanted to live there. Conversely, 22 percent lived in suburbs but 39 percent wanted to live there.

This isn’t bulletproof evidence of anything, and there are some surveys that produce more complicated results. What’s more, there’s also some evidence of a small rise in the preference for urban living over the past couple of decades.

That said, the main finding of nearly every survey on the subject is that millennials mostly want to live in suburbs, and as they grow older that preference increases. There’s hardly any evidence at all suggesting that there’s a huge pent-up demand for city living that’s going unmet.

Obviously there are local exceptions to this finding.¹ Without even bothering to look, I think we can assume that the Bay Area has way less housing than it needs. The same is true of a small number of other cities that have shown big housing price increases over the past 30 years:

The average increase in the cost of housing (relative to income) is about 5 percent for all cities since 1990, and only half a dozen cities have seen increases of more than 15 percent. Put this together with survey data and rental vacancy rates and there’s little evidence of a huge surge of millennials who want to move to cities but can’t. In fact, just the opposite.

¹Though, surprisingly, not demographic ones. There’s a higher preference for city living among liberals, the young, and the college educated. However, even in these demographics there’s still a substantially higher preference for suburbs than for cities.