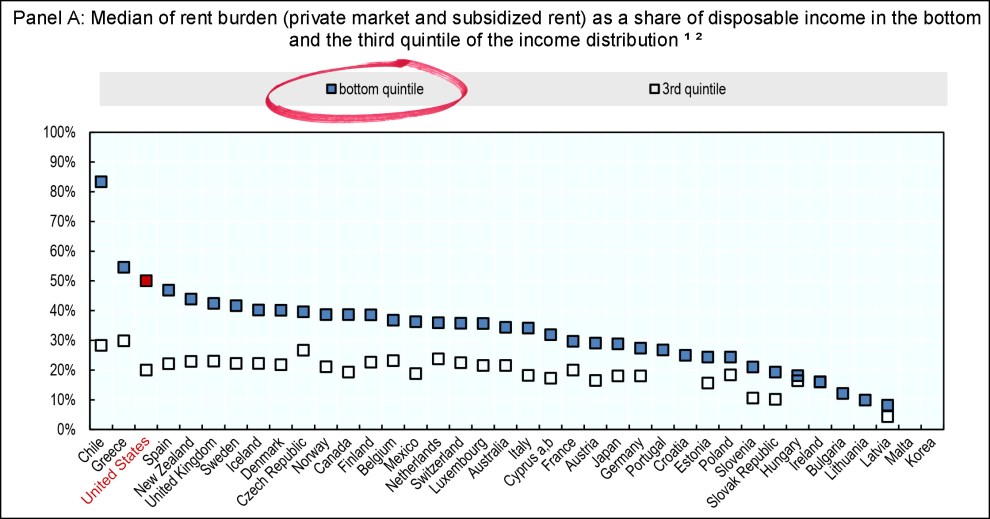

More housing charts! I came across these while reading about the shortage of starter homes, and they were interesting in different ways. First up is a chart from Bloomberg that shows total rent as a percent of total disposable income:

There are two ways to look at this. The rental market obviously goes though a boom-and-bust cycle, and right now we’re near the peak of a boom. Since the early aughts, total rent has soared from about 2.8 percent of disposable income to 3.8 percent. That’s an increase of about a third over the course of only a dozen years, which amounts to a real growth rate of 3 percent per year. That’s a lot. (Note, however, that some of this is due to higher levels of rentership following the housing bust. If more people are renting, then total rent paid also goes up even if prices remain the same.)

The other way to look at this is to follow rent from peak to peak of the cycle. If you do that, total rent has increased from about 3.7 percent of disposable income to 3.8 percent. That’s an increase of one-thirtieth over the course of 60 years, which amounts to a growth rate of only 0.05 percent per year.

Which one of these is the “true story”? Both of them. It just depends on what you happen to be interested in. Or what point you feel like making.

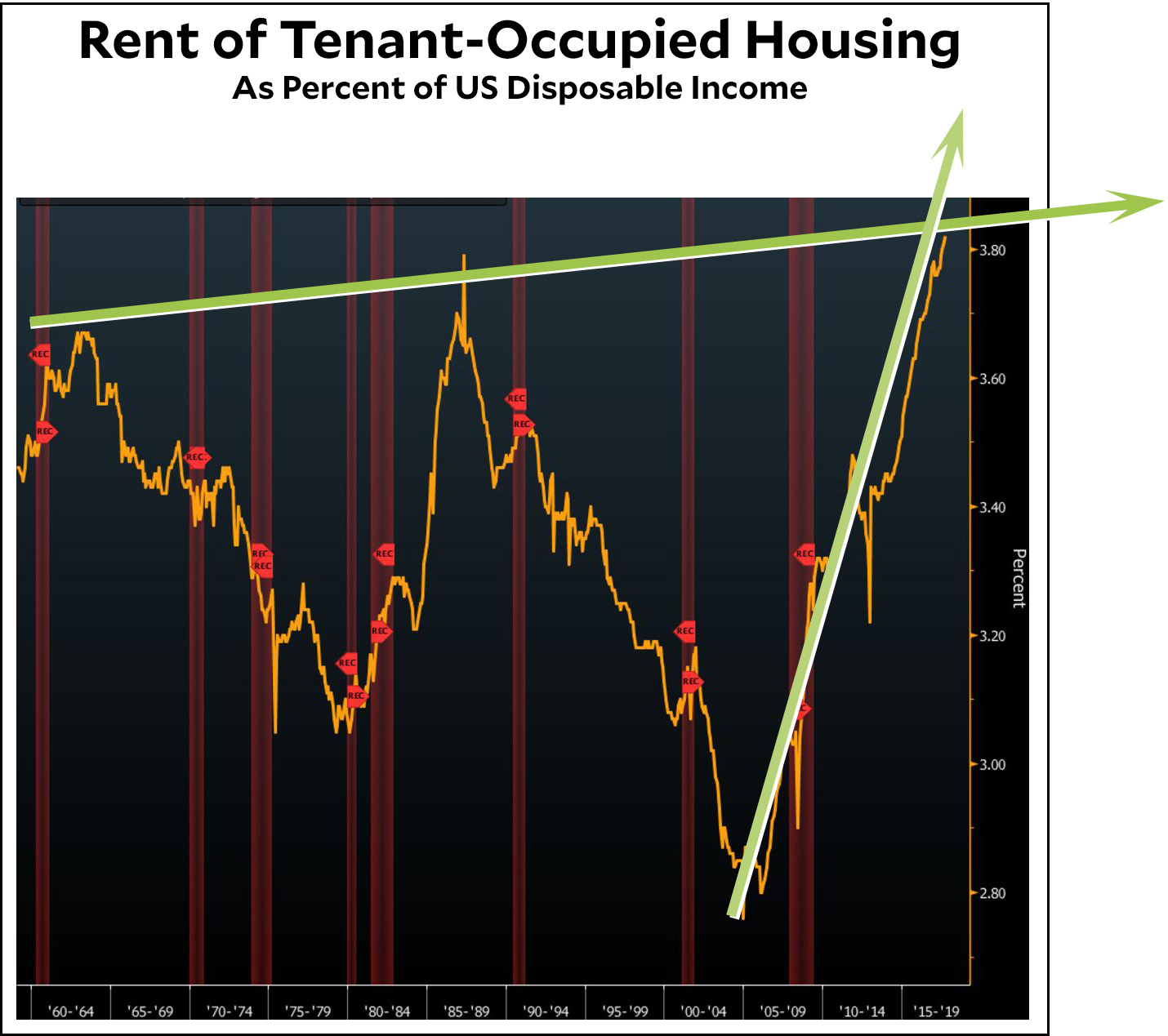

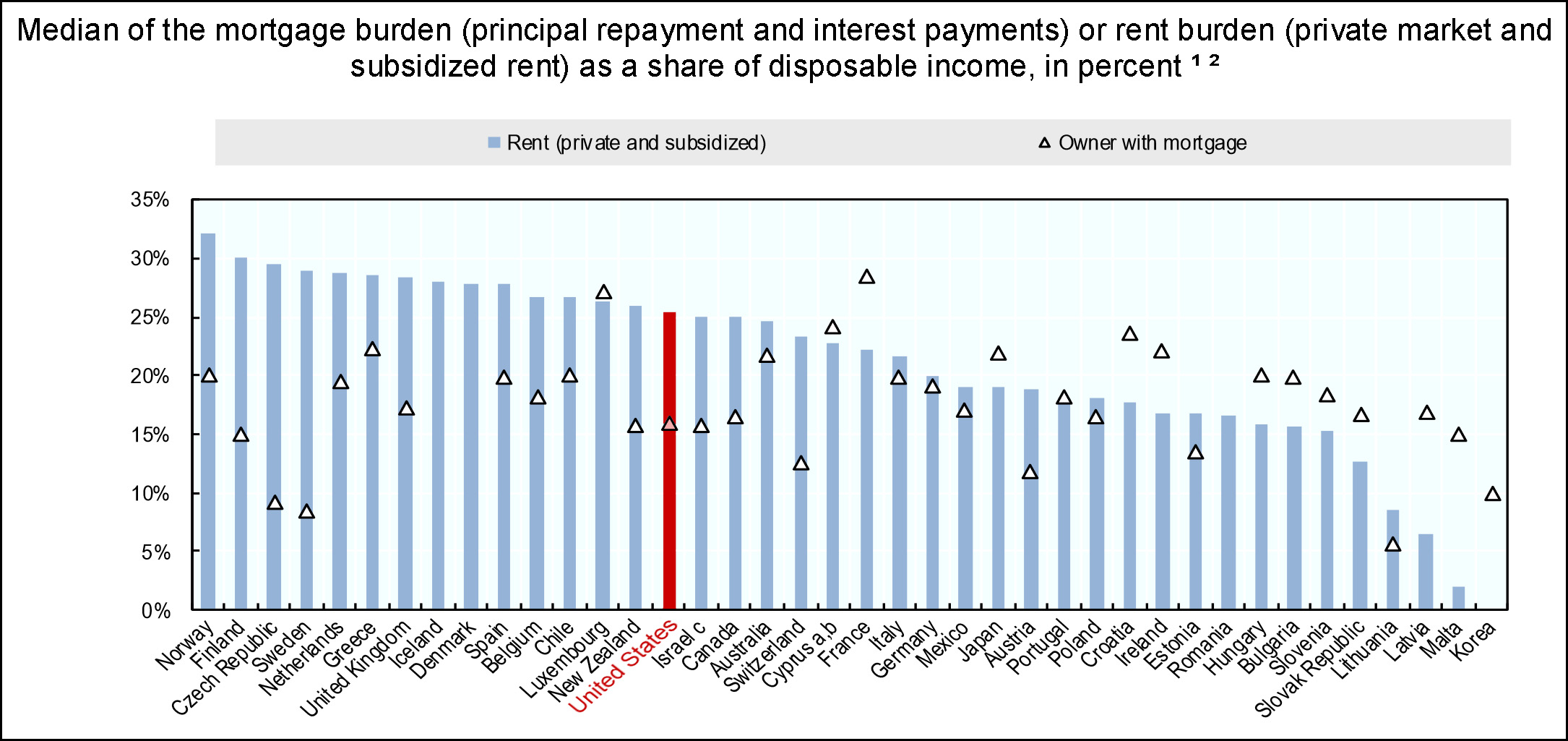

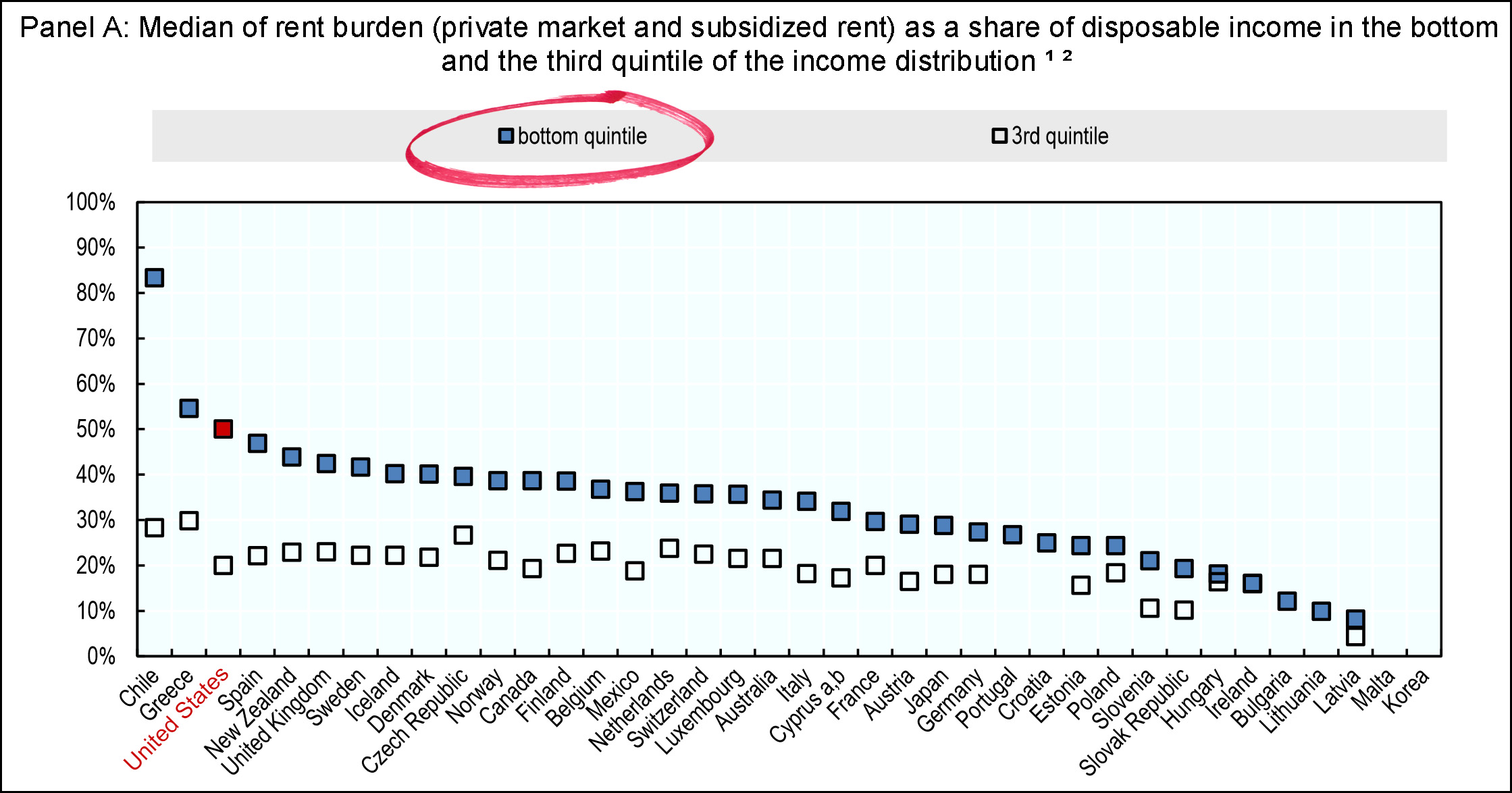

Next up is a pair of charts from the OECD. They don’t show housing burdens over time, but they do compare housing burdens in the rich countries of the world, which is kind of interesting. Here’s the first one:

This shows both median rents and median mortgages as a percent of disposable income. On this metric, the United States comes in a little above average on rents and a little below average on mortgages. But what about low-income households?

This is the average of the bottom quintile, which means we’re looking at the very poor (roughly the bottom 10 percent). On this metric the US does badly, clocking in with the third-highest rent burden. This chart includes government subsidies, which is the big difference maker. The market price for low-end housing in the US is probably similar to other peer countries, but we simply don’t provide the poor with as much assistance. As a result, the very poor pay upwards of 50 percent of their income for housing, compared to about 30 percent for countries like Germany, Japan, and France.