The Wall Street Journal suggests that everyone’s favorite recession indicator is probably wrong:

The market’s most-popular recession warning is flashing red again as fears about the economic impact of China’s coronavirus outbreak prompt a big drop in Treasury yields. Yet the warning—a drop in the 10-year Treasury yield below the three-month bill, known as an inverted yield curve—is signaling something much more benign: the expectation of Federal Reserve support later this year.

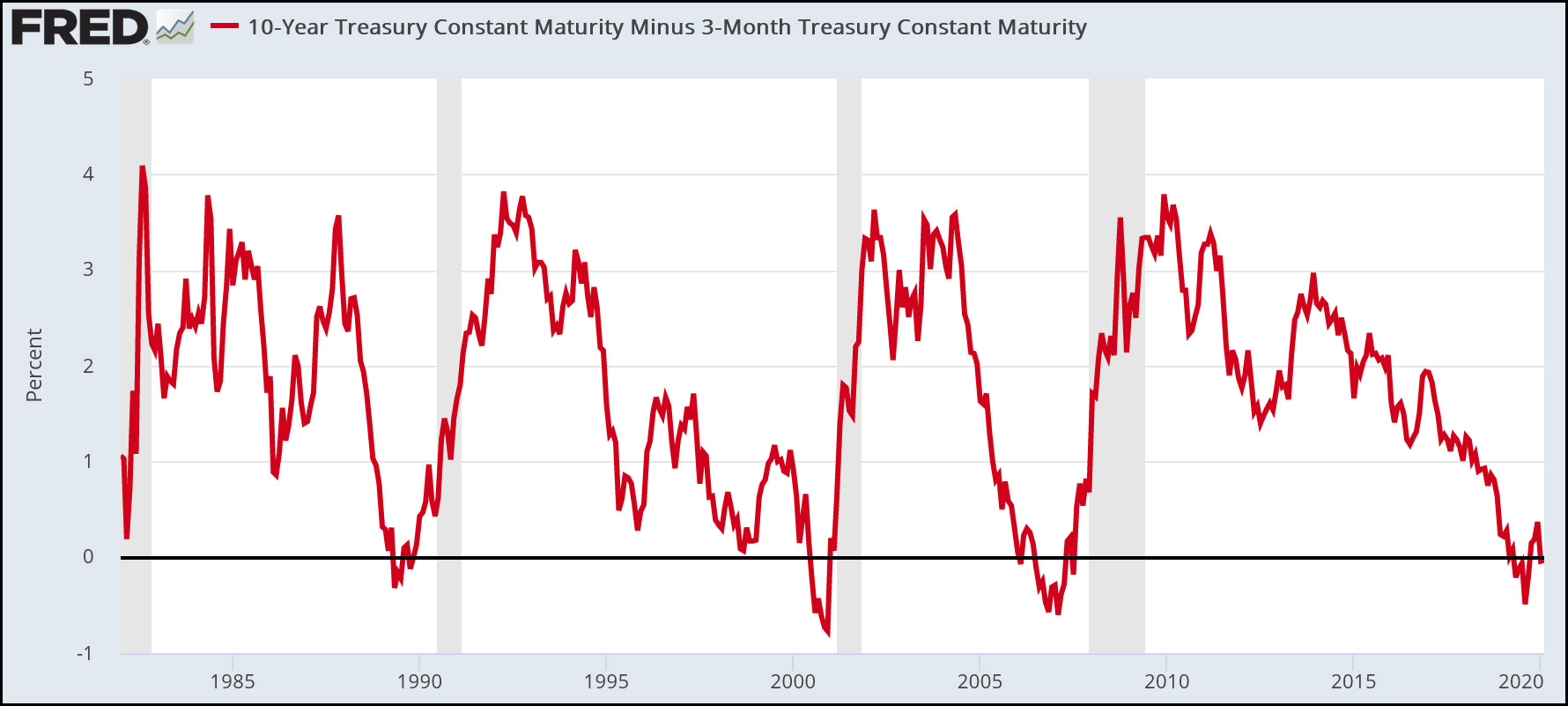

Well, that’s that. Whenever people finally become indifferent to some particular economic warning, that’s a strong sign that we’re about to get bitten in the ass. Here’s what the yield curve looks like:

When financial reporters talk about inverted yield curves, they always mention the bright side: although inversions do seem to predict recessions, it can take as much as a year before the recession comes. Unfortunately, as you can see, the yield curve actually dropped below zero last summer and has been near zero ever since. If it drops again, it’s probably best to treat the entire period as a single episode, which means we’ll get another recession by mid-2020.

Or not. I mean, the yield curve is sort of a mysterious thing, and it “always” predicts a recession until it doesn’t. On the other hand, there’s a brand of economic analysis that looks at everything in terms of “oh, this thing that looks like bad news is actually good news because it will force the Fed to loosen up monetary policy.” I’m not fond of it. The Journal plays this card today with a subhead that literally says things are “different this time.”

Maybe so! I sure don’t know. But I’ll be resting a little uneasy for the next few months.