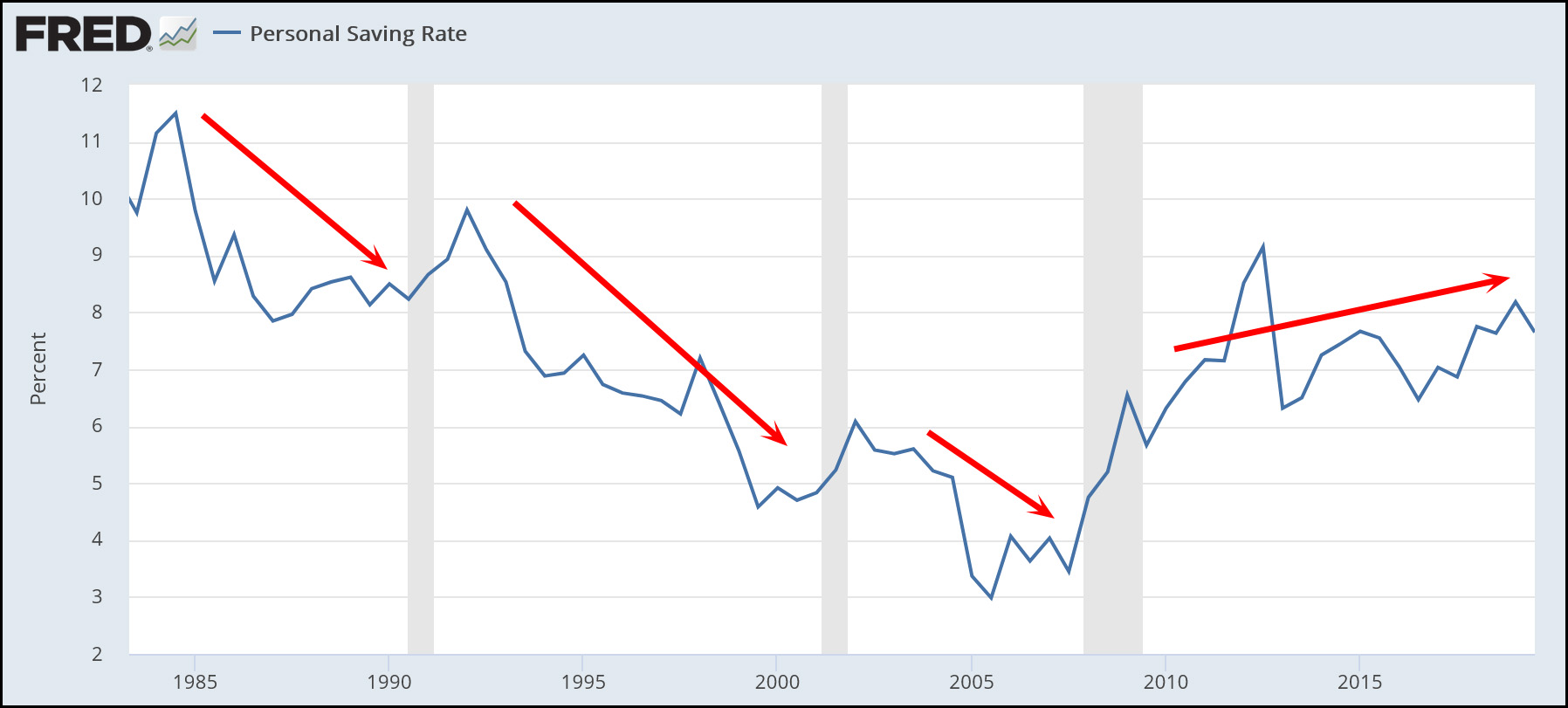

If the coronavirus shock puts the economy into a recession, how should we respond? Here’s the chart that makes me ask the question:

In all recent recessions, the personal saving rate has plummeted beforehand, which makes it hard for consumers to respond to the shock of losing income. Their only option is to reduce their consumption. But that’s not true right now. After the Great Recession, the saving rate spiked upward and has continued to grow at a modest rate ever since.

So here’s my question, aimed at serious economists because it’s above my pay grade: would a normal stimulus work in a case like this? If a recession hits and savings are low, people are forced to cut back on spending and this is what propels the recession. Putting big chunks of money in their pockets without bothering too much about targeting it is obviously a good thing. But if savings are high, what’s the point? People have money to spend, so that’s not the problem. They’re just afraid to spend it (or can’t spend it because businesses are shut down).

There are, of course, plenty of individuals who are going to lose their jobs and can’t make up for that out of savings. On a purely humanitarian basis, we should do everything we can to help them. I have no argument with that. My question is solely macroeconomic: would a large, general purpose stimulus be much help in a situation like the one we face now, where savings are high and the spending shock is obviously extremely temporary?