A new study published in Nature estimates that lockdown orders around the world “prevented or delayed on the order of 62 million confirmed cases, corresponding to averting roughly 530 million total infections.” That’s a lot! However, be aware that this is, as usual, based on a model of COVID-19 spread that may or may not be accurate.

In the US, the authors estimate that as of April 6, countermeasures reduced the number of cases by 4.8 million, or about 20,000 deaths using the current best estimate of the infection mortality ratio. That’s a whopping 93 percent decrease in cases and a 70 percent decrease in deaths.

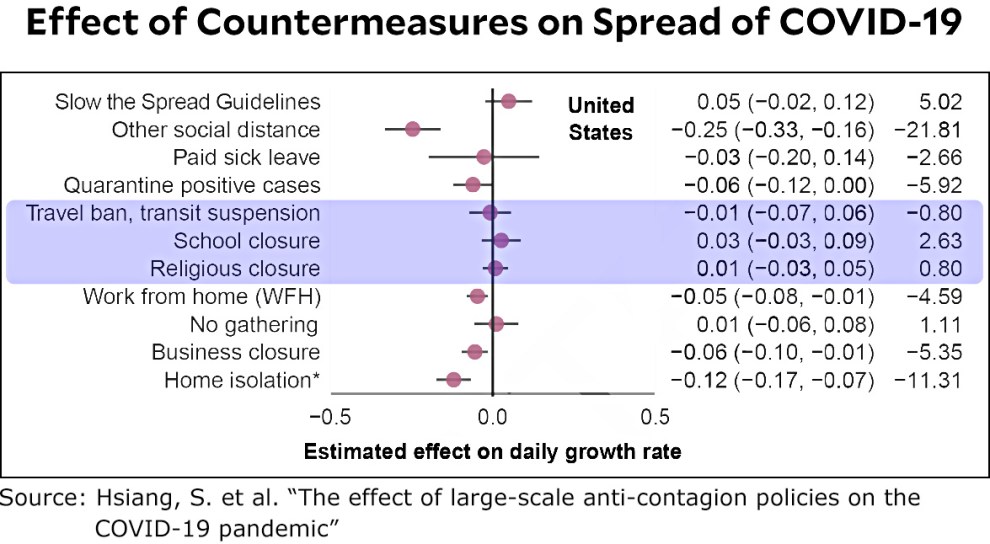

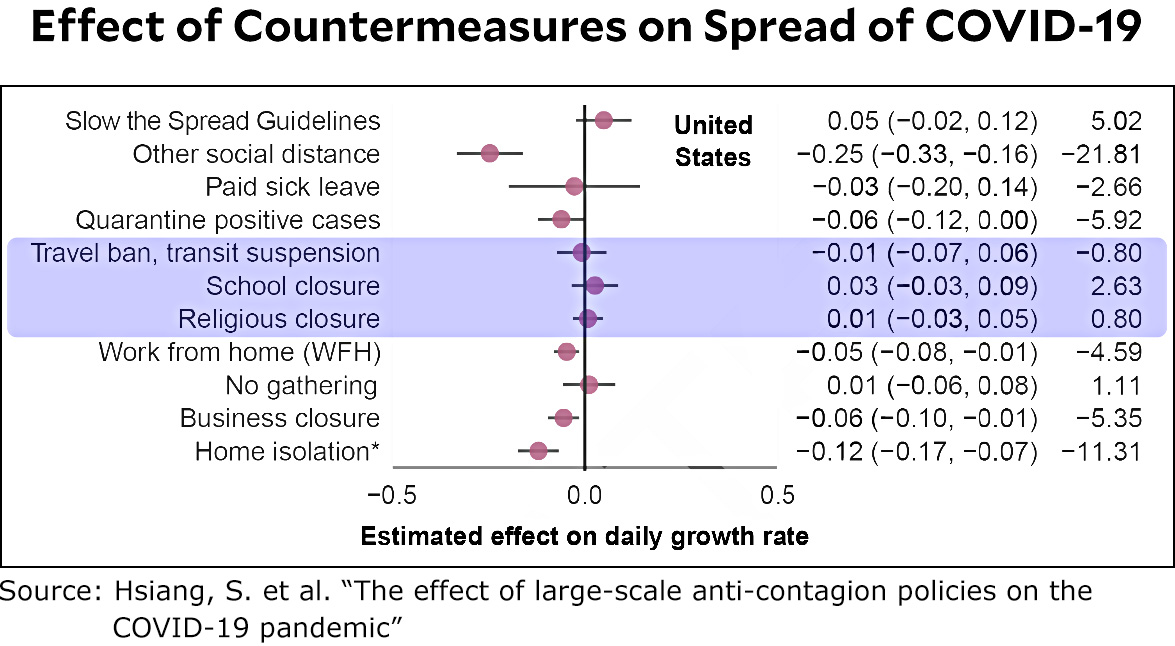

But that’s not what interests me. This is:

The authors tried to tease out the impact of individual countermeasures and they confirmed what other studies have shown. First, school closures have no effect. Nor does shutting down churches. Travel bans are also ineffective. Just generally, rules banning large gatherings appear to have little impact. The measures with the highest impact are business closures, quarantines, home isolation, and general social distancing.

All of this has to be considered tentative, but this is now the third study I’ve seen showing that school closures have no effect—or even a slightly negative effect. These are empirical studies, and it’s frustrating that they don’t tell us why school closures have so little impact. Nonetheless, that’s what they show. I hope we take this to heart and re-open schools in the fall without thinking we have to take massive and debilitating (and expensive) countermeasures. There are some obvious things we can do to protect both kids and teachers, but generally speaking, it sure looks like only modest measures are needed to re-open schools safely without increasing the danger of COVID-19 spread.