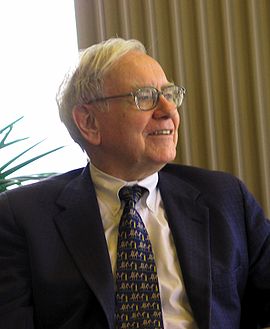

Bloomberg News reports today that, according to the bond market, you’re safer investing in Warren Buffett than in what used to be the safest of all bets—the US government. The yield on bonds offered by Buffett’s storied Berkshire Hathaway last month had a yield that was 3.5 basis points, or 0.035 percent, lower than the US government’s Treasury bonds—essentially American debt. Joining Buffett in the safer-than-US-debt category as well were bonds for household names like Proctor and Gamble, Johnson and Johnson, and Lowe’s, the home improvement store. “It’s a slap upside the head of the government,” one financial officer told Bloomberg.

So what’s it mean? For one, that the US is selling massive amounts of Treasury bonds—$2.59 trillion since the start of 2009—to borrow money to finance its projects like the stimulus package, bailout, wars in Iraq and Afghanistan, and Obama’s other projects. So much money, in fact, that the US will pay 7 percent of revenues to service its debt this year, according to Moody’s rating service. According to the Congressional Budget Office, the federal budget proposed by Obama will create record deficits of more than $1 trillion this year and next, and the total deficit between 2011 and 2020 would reach $9.8 trillion, or 5.2 percent of GDP. The US’ looming debt crisis is getting so bad and threatening to swallow so much money that Moody’s said earlier this month that the US was “substantially” closer to losing its AAA debt rating, the gold standard of bond rating.

From a strictly financial standpoint, the Buffett-Obama comparison highlights just how grim the US’ fiscal situation is. It’s one thing to borrow deeply to try to create jobs, backstop an ailing housing market, and restart the American economy. But on the morning after the passage of a historic health care bill, the Bloomberg story nonetheless offers a rude awakening as to how deep in debt this country really is.