The Obama administration is back in court today, appealing last month’s decision by a Louisiana court to throw out its temporary moratorium on new offshore drilling. But just like the judge who first struck down the moratorium, the judges on the 5th Circuit Court of Appeals panel that will hear the case have financial holdings or other ties to the oil and gas industry.

Only three judges from the panel in the 5th Circuit Court of Appeals in New Orleans will hear the appeal of the case, Hornbeck Offshore Services LLC v. Salazar. The Alliance for Justice (AFJ) looked at the financial records of the three-member panel that will hear the Obama administration’s appeal and found that two of the judges, Jerry Edwin Smith and William Eugene Davis, “frequently represented the oil and gas industries while in private practice.” Smith represented Exxon, Conoco, and Amoco, as well as others. Davis represented Diamond Drilling Company in private practice, and has also held stock in Edge Petroleum and Progress Energy.

Both Davis and Smith have also attended all-expense paid “seminars” sponsored by the Foundation for Research on Economics and the Environment (FREE), a free-market organization whose seminars focus claim to be “pro-environment,” but focus on explaining “why ecological values are not the only important ones.”

The third judge on the panel, James L. Dennis, has had financial holdings in at least 18 companies in the energy industry. He used to own stock in Deepwater Horizon rig owner Transocean, but sold it in 2006. His 2008 financial disclosure listed a range of investments in oil and natural gas producers, suppliers, distributors, and service companies.

Davks, Smith, and Dennis aren’t the only 5th circuit judges with ties to the industry. AFJ surveyed all the judges, both active and senior (which means they are essentially retired but can still volunteer to hear a case) members, and found that many of them have ties to the oil and gas sector, whether through stock holdings or a history of representing the industry in private practice.

Based on 2008 financial disclosure forms and responses to Senate Judiciary Committee questionnaires, AFJ also reports that Edith Jones, the chief judge on the panel, has invested in Exxon Mobil, Pennzoil, BP, and Amoco, among other energy firms. Carolyn King has invested in Exxon and BP. Jacques Wiener has invested in Exxon and Chevron, among others. Harold DeMoss has invested in several energy companies, including Anadarko Petroleum, which owns a 25 percent share of the well currently spewing oil into the Gulf. Edith Clement has held stock in Exxon, Texaco, BP, Chevron, and Conoco. The list goes on and on—basically, there are very few 5th circuit Justices who don’t have some sort of financial connection to the oil and gas industry.

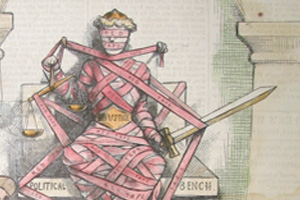

AFJ President Nan Aron argues that the Fifth Circuit is “marinating in a pervasive oil culture,” which should present “legitimate questions about potential bias.” While she said they’re not accusing the court of any wrongdoing, she suggested that most on the circuit should recuse themselves from the case.

“The justice system’s legitimacy depends on the confidence that individuals have in its ability to be fair and impartial,” Aron says. “Given the significance of this case and the national attention it is receiving, it is important for judges to appear as fair and impartial as possible.”

But as has been noted many times now, it’s hard to find a judge in the Gulf without ties to the industry. In the region, 37 of 64 federal judges have some oil sector connection.

Oral arguments begin this afternoon in New Orleans. The court is expected to move quickly on a decision, as the administration wants the six-month moratorium back in place and drillers in the area are itching to get back in the waters. Meanwhile, environmental groups are pushing to get the US District Court to revoke Judge Martin Feldman’s decision in the case revoked, arguing that of his holdings in the energy industry constitute a conflict of interest. “The Court’s financial holdings in various companies involved in oil and gas drilling raise in an objective mind a reasonable question concerning the Court’s impartiality in these proceedings,” the motion from the environmental groups said in the filing.