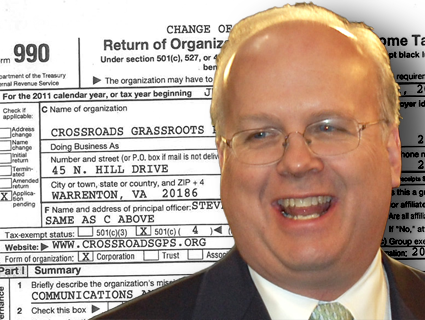

Image of Karl Rove by <a href="http://www.flickr.com/photos/33876038@N00/2824584419/">chicagopublicmedia</a>/Flickr

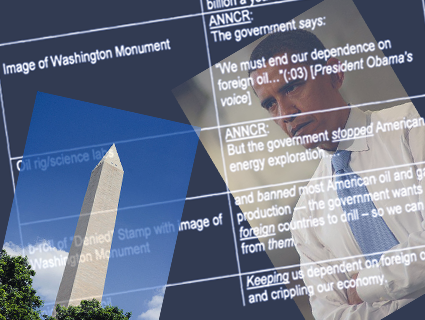

As they dominate the airwaves with political ads, dark-money nonprofits are coming under increased scrutiny. At issue is the charge that they’re running afoul of their tax-exempt status by focusing on partisan political activity. Earlier this week, New York Attorney General Eric Schneiderman sent subpoenas to a nonprofit affiliated with the Chamber of Commerce to see if millions of dollars had been improperly funneled to the Chamber (a 501(c)(6) nonprofit) for political purposes.

Now, the Wall Street Journal reports, the Internal Revenue Service has begun a process of determining whether Karl Rove’s Crossroads GPS should have to give up its nonprofit 501(c)(4) status and disclose its donors. Democrats and campaign-finance watchdogs have been urging regulators to crack down on groups like Crossroads GPS; last week the Obama campaign’s top lawyer sent a snarky letter to Rove saying he was filing a complaint with the FEC “laying out the case—obvious to all—that Crossroads is a political committee subject to federal reporting requirements.”

If the IRS revokes Crossroads GPS’ or other 501s’ nonprofit status, the Journal explains, “the organizations could be held liable for large tax bills for the millions of dollars they have received tax-free.” However, reaching such a determination will likely take months. Which means that dark-money groups can keep spending freely on ads and promising anonymity to their donors through the November election.

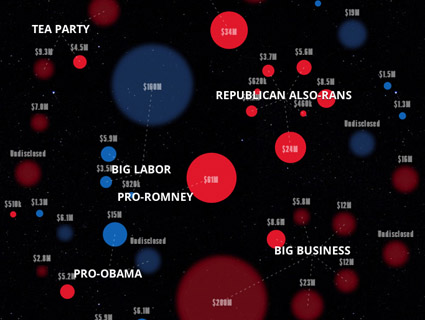

For more, check out our interactive dark-money universe map, which tracks Crossroads GPS and 17 other 501 groups.