Corning International, the company best known for its heat-resistant glass cookware, paid zero federal income taxes on nearly $1 billion in income last year, but apparently that was still too much. Testifying at a House Ways and Means Committee hearing on corporate tax policy on Friday, Corning vice-president Susan Ford asked Congress for “a substantial reduction” in Corning’s corporate tax rate.

To be fair, Corning would pay Uncle Sam much more than nothing it didn’t resort to arcane accounting maneuvers. Ford told members of Congress that Corning paid a 36 percent income tax last year, but what she didn’t tell them is that Corning once again deferred its tax payments. According to the watchdog group Citizens for Tax Justice, Corning has paid zero taxes in the past four years. Between 2008 and 2010, a period in which Corning made $1.9 billion in U.S. profits, Corning actually received a $4 million tax refund.

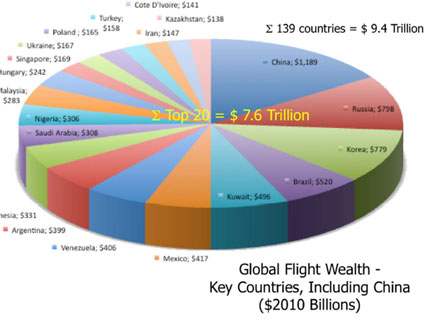

The hearing on corporate tax policy comes at a time when the White House has proposed lowering corporate tax rates while closing tax loopholes, leveling the playing field for business. The changes are supposed to be revenue neutral, though Corning and other companies seem to want more. “American manufacturers are at a distinct disadvantage to competitors headquartered in other countries,” Ford told members of Congress. “Specifically, foreign manufacturers uniformly face a lower corporate tax rate than U.S. manufacturers.”

Except when they don’t. In 2011, Corning paid an average foreign tax rate of 17 percent—far more than what it paid in the United States.