Mitt Romney (right), and his new running mate, Rep. Paul Ryan.<a href="http://www.youtube.com/watch?v=dm_6NVB3TR0&feature=player_embedded">DemRapidResponse</a>/YouTube

Awkward. On 60 minutes, Ryan talks eliminating tax shelter loopholes as Romney tries not to look horrified.

Mitt Romney and his newly anointed running mate Paul Ryan didn’t make much news in their first joint interview of the campaign on Sunday on 60 Minutes. But one exchange stood out: When asked about the fairness of his tax plan by CBS’s Bob Schieffer, Romney fought back against the suggestion that his policies would disproportionately favor the most wealthy. Here’s what Romney said:

Fairness dictates that the highest-income people should pay the greatest share of taxes, and they do. And the committment that I’ve made is we will not have the top income earners in this country pay a smaller share of the tax burden. The highest-income people will continue to pay the largest share of the tax burden, and middle income payers under my plan get a break. Their taxes come down. So we’re not going to reduce taxes for high income people and we are going to reduce taxes for middle income people.

Ryan went on to explain that he and Romney would make the system more fair by shutting down tax loopholes that exclusively favor the rich. (In other words, the kind of tax loopholes Romney has taken advantage of.)

There’s a nugget of truth in Romney’s claim that high-income earners won’t pay a smaller share of taxes. He has not proposed replacing the progressive income tax with a flat tax (say, 20 percent for everyone), nor has he proposed giving the highest-income people a lower income tax rate than middle-class people. Under Romney’s plan, many rich people will still pay a higher percentage of their income in taxes than poorer Americans will.

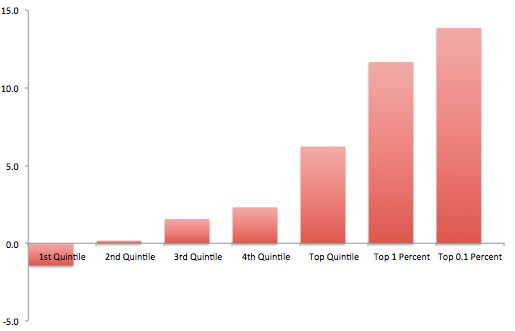

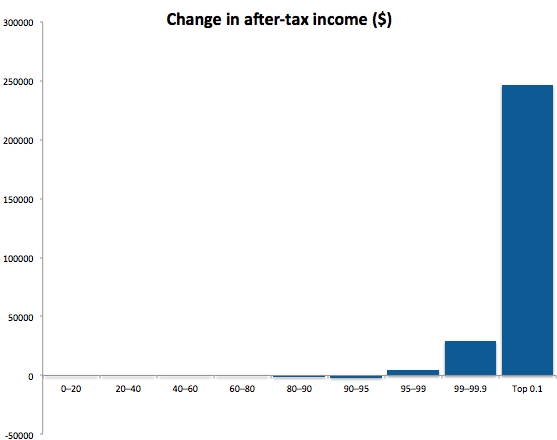

But the larger point is way off. Contrary to Romney’s assertion on 60 Minutes, Romney’s tax plan would amount to an enormous tax cut for the highest earners while raising taxes on the middle class, the working poor, and everyone else in the bottom 95 percent. That’s according to an analysis from the nonpartisan Tax Policy Center. Here’s how it works:

Tax Policy Center data

Tax Policy Center data

Those changes are on top of current policy, which includes the Bush tax cuts. (Ryan’s budget, as I noted earlier, would likewise raise taxes on the lowest earners while disproportionately boosting the uber-rich and cutting Romney’s personal tax rate to just 1 percent of his income by phasing out capital gains and dividend taxes.) If Romney’s new message is that he’s still going to make top earners pay their share, it might be his most audacious spin yet.