MapLight Foundation

Last week, the House of Representatives passed a bill that would allow US banks to get out of new financial regulations by operating through their overseas arms. Financial reformers say this is dangerous because markets are global, and a bad bet made by a US bank operating in another country could easily affect banks in the US and cause the US economy to crash again. Bad for America, but good for banks that want to avoid tough new rules. Perhaps that’s why lawmakers who received more money from banks and the finance industry in recent years were more likely to vote in favor of the bill. House members who supported the bill received more than twice as much in contributions from the financial industry over the past two years as lawmakers who voted against it, according to a new analysis from the MapLight Foundation, an independent research group that tracks campaign finance.

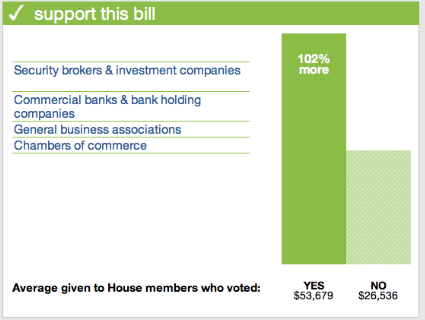

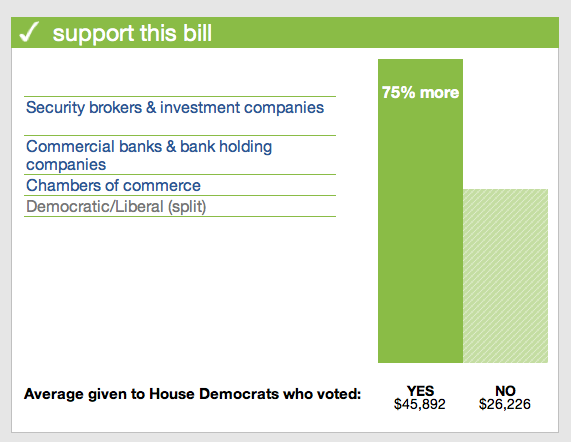

Interest groups supporting the bill, including securities and investment companies, banks, and chambers of commerce, contributed an average of 102 percent more to House members who supported the bill than to those who voted no. Check it out:

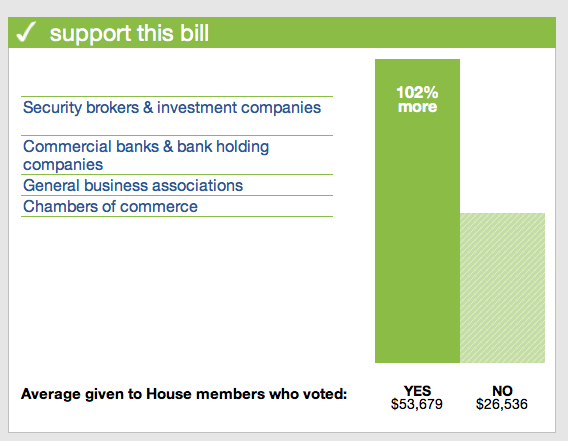

Democratic House members who voted yes on the bill received 75 percent more money from from the financial services industry than Democrats who voted no.

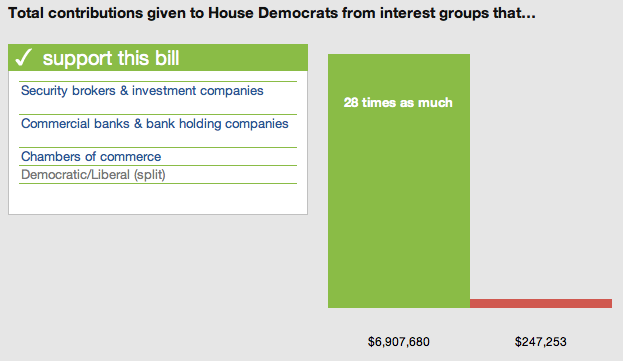

In 2011 and 2012, groups that supported this bill gave five times more to House members than groups that opposed the bill did. The gap was even larger for donations to Democrats. Over those two years, House Democrats received less than $250,000 from interests that opposed this measure. During the same time period, groups in favor of allowing the banks to skirt regulation gave Dems 28 times as much—close to $7 million. Here’s what that looks like:

What’s remarkable is that some Democrats held firm. Although the bill passed the House last week by a vote of 301 to 124, most Democrats voted against it, which financial reformers say is a significant turn of events. “A majority of Democrats voted against a pro-Wall Street bill…even though it was co-sponsored by Democrats… that was heavily lobbied by Wall Street and everyone had predicted would win by a landslide,” Marcus Stanley, policy director at Americans for Financial Reform, told Mother Jones after the vote last week. “I’m pretty psyched.”