As bright-eyed college freshmen arrive on campus, they can look forward to accruing knowledge, independence, lifelong friendships—and serious bills. In the 2012-13 school year, first-year, on-campus tuition averaged $43,000 at four-year, private schools and $21,700 at in-state public schools.

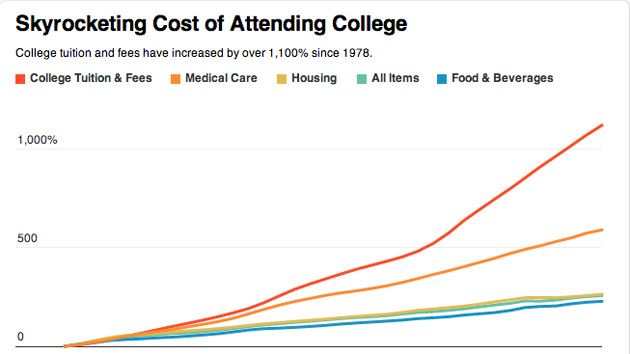

It wasn’t always like this: The cost of undergraduate education is 12 times higher than it was 35 years ago, far outpacing inflation. While the indexed price of college tuition and fees skyrocketed by more than 1,122 percent since 1978, the cost of medical care rose less than 600 percent, and the cost of housing and food went up less than 300.

Back in 1993, 47 percent of college students graduated with debt, owing an average of $9,450 per grad. As tuition rates have shot up, so has student debt: 71 percent of the class of 2012 graduated with outstanding loans, owing an average of $29,400. That’s more than 65 percent of the entire first-year salary of an average recent grad.

That debt has lasting consequences. Households headed by a young adult (under 40) with a college education and student debt have a median net worth of just $8,700. Student debt constrains young people’s ability to start a business, buy a home, or pursue a public-interest career.

In June, Republicans blocked Democratic Massachusetts Sen. Elizabeth Warren’s proposed student loan reform bill, which would allow about 25 million Americans to refinance their older federal loans (some of which are locked into interest rates of 9 percent or higher) at the current, lower rate. (At the time the bill was introduced, the interest rate was 3.86 percent; it rose to 4.66 percent in July.)

Warren has also advocated for more sweeping reforms, including a rejected amendment to the Higher Education Act of 1965 that would give students the same low interest rate enjoyed by banks—0.75 percent. As Warren argued the case in a MoveOn.org petition: “Wall Street banks—the ones that wrecked our economy—should not be getting a better interest rate on their government loans than young people trying to go to college.”