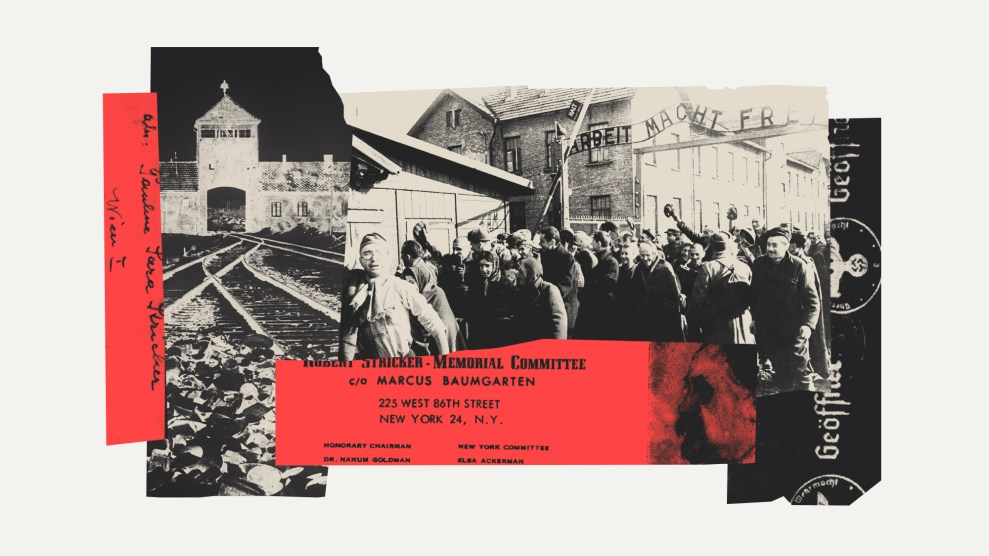

Allen Weisselberg, chief financial officer of the Trump Organization, stands behind the Trump at a 2017 press conference in Trump Tower.Evan Vucci/AP

Fight disinformation:

Sign up for the free

Mother Jones Daily newsletter and follow the news that matters.

Allen Weisselberg, the chief financial officer of Donald Trump’s company, surrendered early this morning to the office of Manhattan District Attorney Cy Vance. A federal grand jury yesterday returned indictments against Weisselberg and the Trump Organization in connection with Vance’s long-running investigation into alleged tax fraud by the company and its executives.

The precise charges against Weisselberg and the company are not yet clear. The indictments are expected to be unsealed this afternoon. But it has been widely reported that Vance—as he ratcheted up pressure on Weisselberg to cooperate in his probe—has zeroed in on tax crimes related to lucrative fringe benefits provided by Trump’s company to Weisselberg.

“Allen Weisselberg is a loving and devoted husband, father and grandfather who has worked at the Trump Organization for 48 years,” a Trump Organization spokesperson said in a statement, blasting the charges. “He is now being used by the Manhattan District Attorney as a pawn in a scorched earth attempt to harm the former President. The District Attorney is bringing a criminal prosecution involving employee benefits that neither the IRS nor any other District Attorney would ever think of bringing. This is not justice; this is politics.”

Weisselberg has worked for the Trump family since 1973, starting off as an accountant for Trump’s father, Fred. He rose through the ranks of the small Trump Organization to become Donald Trump’s chief financial advisor. An indication of how indispensable he has become: When Trump took office, he turned over day-to-day control (though notably not ownership) of his business to his two adult sons, Don Jr. and Eric—and Weisselberg.

New York prosecutors have been pressing Weisselberg to cooperate for months, investigating both him and his son, Barry, who also worked for the Trump Organization, running the Central Park ice skating rink the company manages. Investigators focused on the lavish benefits the Weisselbergs received from Trump on top of their salaried compensation, including luxury car leases, apartments, and $500,000 in tuition payments for Weisselberg’s grandchildren at a tony Manhattan private school once attended by Trump’s son, Barron. Reportedly, neither Weisselberg nor his son have cooperated. While giving employees perks is not illegal, there are complex rules governing how these benefits must be valued and taxed.

The charges against Weisselberg and the Trump Organization may be just the start of the legal peril the former president and his company face. Vance is continuing to investigate other tax issues that could spur more serious charges. These include allegations that Trump’s company misrepresented the value of properties to gain tax benefits. Vance is also working with New York Attorney General Letitia James, who for several years has run her own sprawling civil investigation into potential wrongdoing by the Trump Organization and the Trump clan. Among other things, James has looked into the potential misuse of multi-million dollar conservation easements on a Trump-owned estate in upstate New York and whether Trump properly paid taxes on a $130 million loan tied to his Chicago tower that he settled with a lender at a steep discount when he was unable to repay the full amount.

This is a developing story.