Diane Weiss and Kristen Svihlik live 1,700 miles and a generation apart. Weiss, 60, is twice divorced with a grown daughter, and resides by herself in a one-bedroom apartment in Mesa, Arizona. Svihlik is 38 and lives in a fixer-upper in Akron, Ohio, with her husband, their 6-year-old son, and a newborn daughter. The two women have never met, but they uttered precisely the same words to me on the exact same day: “I’m going to have to work until I die.”

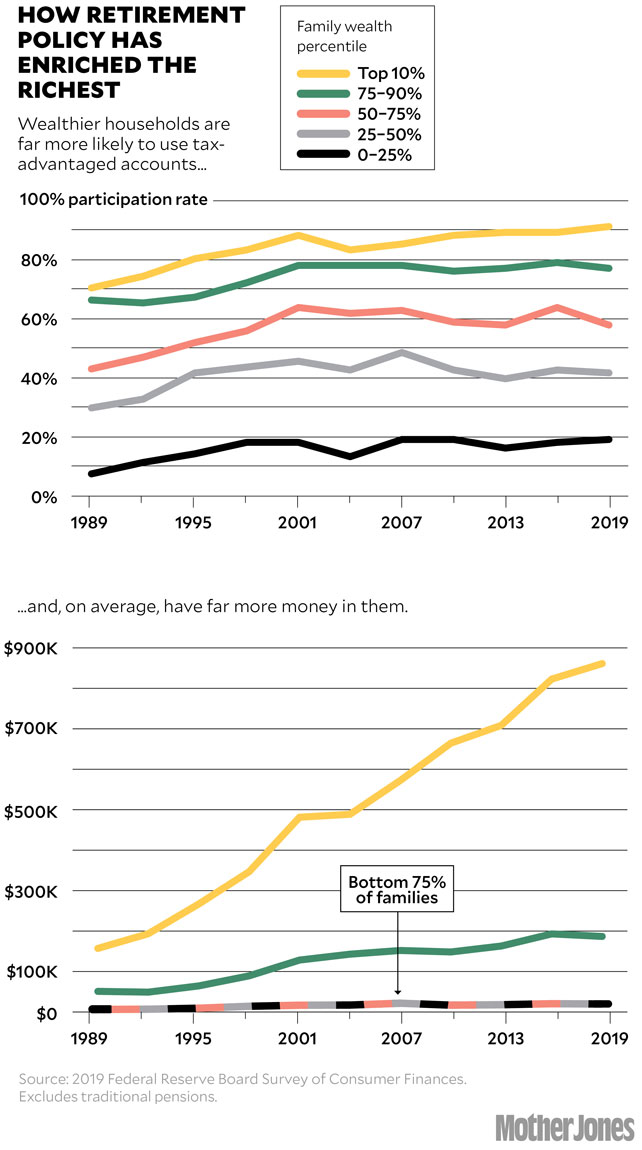

That is not an uncommon sentiment in America today, where a relative few have enough money socked away to see them comfortably through the so-called golden years. The Federal Reserve’s latest survey of consumer finances (SCF) shows that among the poorest 50 percent of families, less than a third participated in a tax-subsidized retirement plan in 2019, while 91 percent of families in the wealthiest 10 percent did.

The federal data (for technical reasons) excludes traditional company pensions, which have been increasingly replaced by “defined contribution” plans like 401(k)s and 403(b)s that shift the savings burden from employer to employee. And while that shift may account for some portion of the chasm in savings, the vastness of today’s retirement wealth gap is largely the result of a string of Wall Street–backed tax incentives that have been a mother lode for the rich but of little use to the poor. Based on the SCF results, Steven Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center, calculated that the average family in the bottom half of the wealth spectrum held just $6,900 in retirement savings, including individual retirement accounts (IRAs), while the wealthiest 10 percent of families averaged $861,300.

This 125-to-1 disparity is astonishing, considering the vast amount of revenue tax collectors give up in the name of helping families build their nest eggs. Retirement-related incentives will cost a total of $1.9 trillion from 2020 to 2024, according to the congressional Joint Committee on Taxation (JCT), making them the US government’s single biggest tax-related expense—more than twice the $1.85 trillion price tag of the 10-year Build Back Better plan that Sen. Joe Manchin rejected in December, and more than the cost of federal tax breaks for dependents, charitable donations, and capital gains combined. “It’s unbelievable the amounts of dollars at stake, and how tilted they are to the high end,” Rosenthal says. “It’s just staggering.”

Politicians on both sides of the aisle tout these annual subsidies—which have ballooned from an inflation-adjusted $145 million in 1996 to roughly $380 billion today—as tools to help ordinary families save. In reality, a series of bipartisan bills enacted over the past quarter century has exploded the savings gap and made the rich richer. “These retirement reform packages are exceptionally confusing and technical and long and really hard for anyone to sort out,” says Rosenthal, a former JCT attorney. “But embedded in every one are Easter eggs: big giveaways to the retirement industry and to high-net-worth individuals.”

Crafted under the watchful eye of finance lobbyists, some bills have included provisions aimed at giving more low-income workers access to retirement plans. But access is meaningless for people who have no money to spare. Take Weiss, an elementary school registrar who has held low-salary jobs in education for more than 25 years. She worked 15 years for a public school district with a mandatory state-sponsored retirement plan, eventually accumulating more than $65,000. But in 2010, Weiss was laid off—longtime staff went first, she recalls. When she later landed a job with a charter school, she was knocked back down to entry-level pay and had to burn through her savings.

Only this past fall, after her annual pay increased from $35,000 to $44,000, did Weiss finally have enough to cover her bills while making contributions to her new employer’s 401(k). “Rent here is crazy,” she explains. “And then you have a car payment and utilities and, you know, everything! If I’m putting 20 or 30 bucks every paycheck into a retirement account—that’s gas money, that’s some groceries. You’re literally living paycheck to paycheck.” Now, as retirement age approaches, she says, “I’m terrified.”

Svihlik used the word “bleak” to describe her family’s finances. She and her husband, Thomas, work for the same national pharmacy chain. Their taxable income is about $79,000, but with medical and school costs, loan payments, and daily needs, they’ve struggled to make meaningful contributions to their company’s 401(k) plan. Over a combined eight years working for the pharmacy, they’ve only accumulated about $22,000—and have had to take out loans against that balance to make ends meet. “I can’t really think about the future because I don’t see an end,” Svihlik tells me. “I see: ‘I’m 65. Okay, better go clock in.’”

It isn’t too hard, on the other hand, for high-income Americans to afford the maximum retirement contributions the law allows. Some have even found creative ways to game the system. Take Silicon Valley mogul Peter Thiel, who reportedly used pre-IPO stock options valued at a fraction of a penny per share to amass more than $5 billion in a Roth IRA, a type of tax-free retirement account theoretically closed to people who make more than $144,000 a year. As the JCT discovered last year, more than 28,000 Americans had tax-subsidized IRA balances of more than $5 million—nearly 500 of them, Thiel included, had holdings exceeding $25 million. “IRAs were designed to provide retirement security to middle-class families, not allow the superwealthy to avoid paying taxes,” lamented Oregon’s Ron Wyden, the Democratic chair of the Senate’s finance committee.

The savings bonanza kicked off in 1996 when two members of Congress, Rob Portman (R-Ohio) and Ben Cardin (D-Md.), ushered through the first of several big reform packages. Neither “had any particular expertise in retirement policy,” University of Virginia law professor Michael Doran wrote in a January working paper, titled, “The Great American Retirement Fraud.” But the pair “followed the lead of lobbyists representing employers and the financial-services industry” in pushing through two other related bills over the next decade. The 1996 bill, Doran noted, was “the first major relaxation of federal retirement policy in decades.”

Now both senators, Portman and Cardin introduced their latest bill, the Retirement Security and Savings Act of 2021, last May. It was presented, like the others, as a collection of reforms to benefit families and small businesses. “Americans need to save more so they can retire with the dignity and stability they deserve,” Cardin said in a press release. “It’s an ongoing struggle, especially during the pandemic when millions of Americans were without work for months or longer and small businesses struggled.”

But Doran argues that Portman and Cardin’s efforts, alongside similar initiatives, were never crafted with the little guy in mind. Such bills “promised to improve retirement income security for everyone, but instead they delivered expensive and unnecessary tax subsidies to higher-income families and a windfall to the financial services industry.”

Indeed, when celebrating their legislative record, the senators choose their words carefully. They boast of booming total retirement savings—now an estimated $35 trillion—while neglecting to mention how those numbers are skewed toward well-off Americans. “The lawyers, accountants, and wealth managers to the super-rich have fracked every corner of the tax code, especially tax-advantaged retirement programs, to extract benefits for their wealthy clients,” says Chuck Collins, director of the Program on Inequality and the Common Good at the Institute for Policy Studies and author of 2021’s The Wealth Hoarders.

This “wealth defense industry,” for example, helps small businesses set up cash-balance plans, a newer type of tax-advantaged pension that can help company owners enrich themselves. One finance firm’s promotional materials lay out a scenario wherein four highly compensated owner-partners collect 89 percent of their company’s annual contributions—$212,000 each on average—while 20 lower-tier employees share the scraps. There are IRS rules meant to discourage such discriminatory pensions, but Doran says years of lobbying have rendered the rules “anemic.” As Rosenthal puts it, “Businesses have gotten very sophisticated around end-running that policy.”

I reached out to Portman and Cardin to ask why their bills have helped the affluent so much more than ordinary families. A spokesperson responded with a joint statement noting that the senators’ latest bill—which they intend to revive this year—will “help expand access to retirement savings for low-income Americans.” It would increase the age at which retirees must begin cashing out their accounts to 75, and raise the cap on IRA “catch-up” contributions for older workers by $3,000 annually—a move the senators said was “designed to help families who couldn’t save enough when raising children.” But expanded age limits only help those who can afford to wait for the money, as their tax-shielded assets grow even more. And workers like Diane Weiss don’t have much extra cash lying around for catch-up contributions as they head into their 60s.

Is there a way out? “Congress will struggle to solve the problem they created,” Rosenthal warns. “But the longer they wait, the harder it will be.” He suggests lawmakers adopt an Obama administration proposal that would ban further contributions once a person’s combined retirement accounts hit an upper limit (about $4 million), and that Congress strengthen the rules against businesses with retirement schemes that excessively favor the owners over their workers.

Instead of further subsidizing well-off Americans, who respond to each new incentive by shifting more taxable income and assets into tax-deferred or tax-exempt retirement funds, Doran writes, the money could go to any number of things to help people who need it—including beefing up Social Security, a poverty-fighting program that supports 65 million retired, widowed, and disabled Americans and their dependents.

Rosenthal isn’t holding his breath. Last summer, the Senate Finance Committee held a hearing on the retirement system, where Wyden complained that it “doesn’t do nearly enough to help working people of modest means get ahead.” While Rosenthal and a colleague submitted a written statement for the record, the professionals who actually spoke to the committee, he says, were part of what he calls the retirement-industrial complex: “The benefits community, the practitioners, the retirement service industry—they testified,” he tells me. “Nobody was invited to testify who says the emperor has no clothes.”