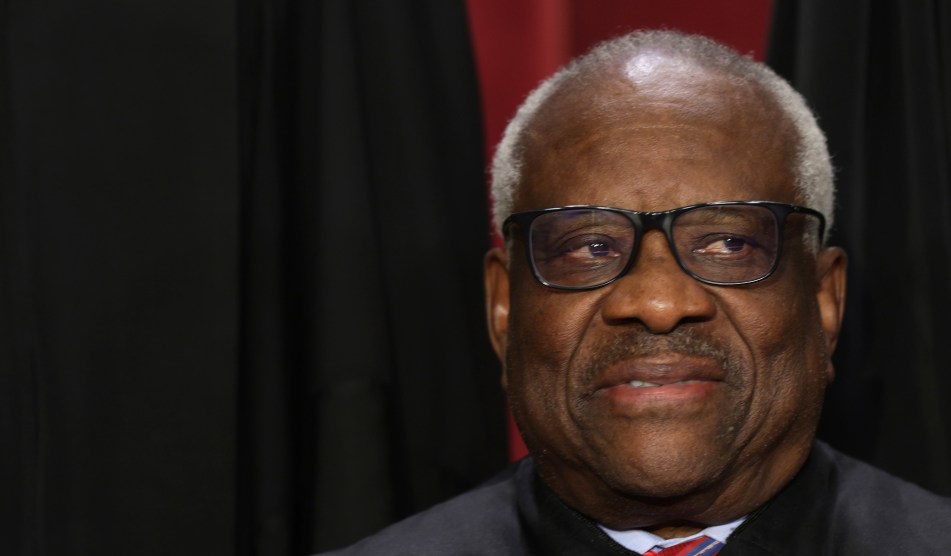

Supreme Court Justice Clarence ThomasJ. Scott Applewhite/File/AP

Over the past two decades, Supreme Court Justice Clarence Thomas has reported on mandatory financial disclosure forms that he received hundreds of thousands of dollars in income from a real estate firm. But that real estate closed its doors in 2006, according to a Washington Post investigation.

The Post found that Thomas erroneously reported income from property that his wife Ginni Thomas’ family developed in Nebraska under the name, Ginger, Ltd., Partnership. That firm was dissolved in 2006 when the leases for more than 200 rental lots were transferred to Ginger Holdings, LLC. Ginni Thomas’ sister, Joanne Elliott, is listed as the manager of Ginger Holdings, LLC. In total, Thomas has reported receiving between $270,000 and $750,000 from the defunct firm.

The Post notes:

The previously unreported misstatement might be dismissed as a paperwork error. But it is among a series of errors and omissions that Thomas has made on required annual financial disclosure forms over the past several decades, a review of those records shows. Together, they have raised questions about how seriously Thomas views his responsibility to accurately report details about his finances to the public.

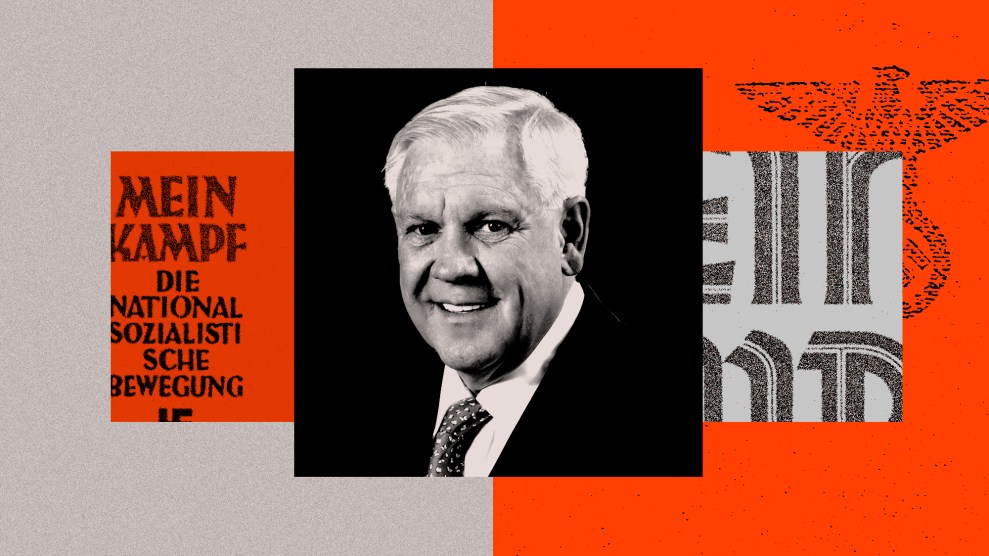

Earlier this month, ProPublica revealed that, for more than twenty years, Thomas has accepted luxury gifts and lavish trips from billionaire and GOP megadonor Harlan Crow without disclosing them. In responding to the allegations, Thomas said that he was advised by colleagues that the luxury trips were “personal hospitality” that didn’t need to be reported. In a statement, Crow said he had “never sought to influence Justice Thomas on any legal or political issue.”

Follow-up stories have noted that Thomas also failed to disclose a 2014 real estate deal with Crow, who subsequently made headlines for being a collector of Nazi memorabilia. The justice also came under fire in 2011, when the watchdog group Common Cause revealed that he had failed to disclose his wife’s income, nearly $700,000 from the conservative think tank, the Heritage Foundation, between 2003 and 2007. During that time, on the disclosure form requiring the justice to disclose his spouse’s income, Thomas checked the box, “None.” Thomas explained the omission as resulting from a “misunderstanding of the filing instructions.”

The increasing attention to Thomas’ various financial arrangements has put a spotlight on the general lack of oversight over Supreme Court Justices. On Friday, congressional Democrats called for Thomas to be referred to the attorney general for an investigation into his “apparent pattern of noncompliance with disclosure requirements.”