Forbes’ annual list of the 400 richest Americans debuted in 1982 with shipping magnate Daniel Ludwig in the top slot. Ludwig’s wealth, the magazine reported, was $2 billion (about $6.3 billion in today’s dollars). That only 13 billionaires graced the first Forbes 400 now seems almost quaint. Who could have imagined billionaires would quickly subsume the entire thing—or that the list might, in the not-so-distant future, hatch its first trillionaire?

This hasn’t happened yet, but we’re on track. The steep upward trajectory of the Forbes 400 is not a matter of entrepreneurs getting better or smarter—or even savvier, really. Rather, it’s a story of congressional capture and decades of policy failures. Ever since the Reagan “revolution,” the United States has lacked a tax mechanism to stop individual fortunes from growing wildly out of control, from becoming something akin to a black hole—devouring ever-greater portions of the nation’s economic pie.

The poorest members of the latest Forbes 400 are worth almost $3 billion, and the share of the nation’s wealth held by the richest 0.01 percent of households has more than tripled since 1982. This disruptive, excessive wealth flows easily from one generation to the next, thanks to an estate tax so easily circumvented that, as one of then-President Donald Trump’s economic advisers famously put it, “only morons” pay it.

Ronald Reagan’s Economic Recovery Tax Act came into effect in the same year Forbes launched its fawning list. Combined with radical changes in the judicial interpretation of antitrust laws and successful attacks on organized labor, Reagan’s tax giveaways kickstarted a massive accumulation of wealth at the very top. On his watch, the top income tax rate was slashed from 70 percent to 28 percent and the top estate tax rate toppled from 70 percent to 55 percent. (It’s 40 percent now—for the morons.)

The Bush years brought yet more tax relief for the rich. But the real doozy came in 2017, under Trump, when a Republican-controlled Congress unilaterally slashed taxes yet again on ultrarich people and corporations, adding trillions to the federal deficit. By 2018, according to economists Emmanuel Saez and Gabriel Zucman, America’s 400 highest earners paid a lower overall tax rate (23 percent) than any other income bracket. (As of 2024, thanks to the same legislation, a wealthy couple can gift their princelings more than $27 million without being liable for a dime of gift or inheritance tax.)

And then there’s wealth protection. Starting in the mid-1990s, Republicans in Congress began attacking the IRS, which they ultimately starved of the funding needed to pursue the hundreds of billions of dollars the ultrarich avoid paying—typically with help from tax lawyers like me. (Some don’t even bother to file.) The federal audit rate for taxpayers with incomes between $5 million and $10 million plummeted from 13.5 percent in 2010 to less than 3 percent in 2019.

These oligarchic policies, and others, have brought America back to Gilded Age levels of inequality. Indeed, per Saez and Zucman, the share of the nation’s wealth held by the richest 0.01 percent of Americans today (10.2 percent) is larger than it was on the eve of the Great Depression.

This is bad for everyone. As Tim Murphy pointed out in his recent Mother Jones cover story, “The Rise of the American Oligarchy,” today’s moguls “exult in their almost godlike status over the politicians they fund, the platforms they own, and the industries they’ve effectively monopolized.”

These “centibillionaires,” as we erroneously refer to the Bezoses and Musks and Zuckerbergs of the world to distinguish them from mere billionaires (“hectobillionaires” would be the accurate term), amuse us with “grandiose proclamations about outer space and immortality,” Murphy writes. But we feel their power “less in the glitter than in the gravity” that power “exerts on everything else”—the pressure that “hardening political and economic inequality puts on public services, on policy, and on the places we live and work.”

We need to realize, he adds, that the story of American oligarchy transcends yachts and private jets: We need to look “beyond the spoils” to “what everyone else is losing.”

As a lawyer who once helped wealthy clients minimize their tax obligations, I recognized some time ago where this was all headed. Yet as recently as 2013, I still assumed—naively—that inequality would hit a tipping point that would jar our collective conscience and prompt policymakers to derail the trillionaire train.

It appears I was overly optimistic.

At least some affluent souls—I now serve as a tax policy adviser for the advocacy group Patriotic Millionaires—along with a small cadre of federal lawmakers, have awakened to the dire threat posed by America’s oligarchs.

During their 2020 presidential bids, Sens. Bernie Sanders (D-Vt.) and Elizabeth Warren (D-Mass.) campaigned heavily on wealth inequality, casting billionaires as policy failures. Soon after Donald Trump departed the White House, Warren introduced the Ultra-Millionaire Tax Act, which would levy a wealth tax on fortunes north of $50 million. President Joe Biden and Sen. Ron Wyden (D-Ore.) followed with proposals to tax the unrealized investment gains of ultrawealthy Americans. (None of the bills succeeded.)

In July 2023, Rep. Barbara Lee (D-Calif.) introduced the Oligarch Act, a proposal I developed for a progressive federal tax that starts at 2 percent on wealth in excess of 1,000 times the median household wealth, increasing to 8 percent on assets exceeding 1 million times the median. (The latter rate would apply to just two people: Jeff Bezos and Elon Musk.) Nineteen representatives have signed on as co-sponsors. Just last month, Warren reintroduced a version of her earlier bill, updated to prevent the ultrawealthy from avoiding the wealth tax by stashing their assets in trusts.

There are, as always, strong headwinds. Congress has shown little appetite for passing any kind of tax on excessive fortunes or paper wealth—or even for closing loopholes that serve no purpose other than to enrich private equity partners or help would-be dynasties transfer tax-free fortunes to their heirs. Many lawmakers behave as though beholden to their wealthy donors, and, more worrisome, so do some prominent judges.

ProPublica has exposed problematic financial ties between billionaires like Harlan Crow and the far-right Supreme Court justices Clarence Thomas and Samuel Alito—whose ultraconservative bloc has flummoxed constitutional law experts with the raw partisanship of its rulings. Last year, a coalition of groups from the same ideological universe persuaded the court to hear Moore v. United States, a case raised for the clear purpose of dooming any future government attempt to tax billionaires’ locked-up wealth.

The Moore opinion, due out by June, will be a strong indicator of whether America’s institutions can withstand oligarchic power.

Which brings us back to our trillionaire problem.

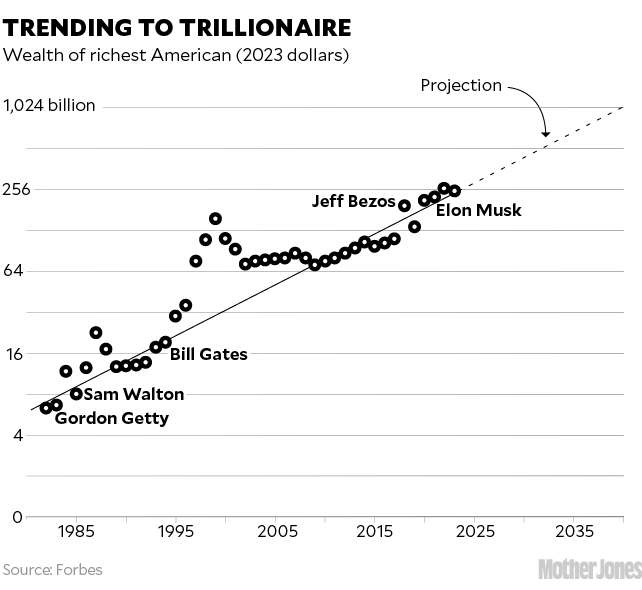

At first glance, the first trillion-dollar fortune seems a long way off. Bezos and Musk have lately been hovering around $200 billion, so there’s $800 billion left to go. (The entire populations of some states don’t possess that much wealth.) The numbers may suggest we’re only about one-fifth of the way from Ludwig’s fortune to Mr. T’s, but really we’re much further along—I’d say almost five-sevenths of the way.

Why five-sevenths? Well, because wealth of great magnitudes grows geometrically, not linearly, so turning $200 billion into $400 billion shouldn’t take any longer than growing $1 billion to $2 billion. To get from Ludwig’s fortune to $1 trillion requires just over seven doublings, and we’ve already had five. Seven doublings get us to $806 billion, and from there only a few more years are needed.

Perhaps your wealth is growing, too, but probably at nowhere near the rate of Warren Buffett’s. From 1989 to 2019, the nation’s median household wealth, in 2023 dollars, increased from roughly $116,000 to $146,000. That’s only a one-third doubling. Over the same period, the inflation-adjusted total wealth of the Forbes 400 soared from $665 billion to $3.6 trillion (2.4 doublings). And the wealth of America’s richest man rocketed from $12.8 billion to $136.7 billion. (Different men, but well over three doublings.)

Such hypergrowth on the uppermost fringe is entirely predictable, given our policies. The top dog of a given year’s Forbes 400 is simply the leader in a relentless game of leapfrog, a mogul whose fortune has expanded at a breathtaking rate, often based on a societal shift, like railroads, the personal computing revolution, an explosion of online commerce, or the development of long-range electric vehicles. Inevitably, the leader’s acceleration decreases and the next guy—an AI founder?—takes over. That’s why the top fortune has doubled some five times since 1982, while the combined assets of the Forbes 400 (now up to $4.5 trillion) represent only four doublings.

It is difficult to visualize the evolution of America’s top fortune on a linear scale. The logarithmic scale I used for the chart below lets us see the trend from 1982 to today, and project Mr. T’s rough arrival date. (No woman has ever made Forbes’ Top 10, but that’s another story.) This is the “over-under” date when it’ll be even odds our first trillionaire has made his appearance. If things continue as they are, we can extrapolate the trend line and predict that T-Day will be upon us—drumroll—circa 2040.

We’ve now answered our big question, but a more pressing one is whether our society can get it together to stave off that dark day. A tax system that keeps the distribution of wealth to within a reasonable range is eminently achievable. The Oligarch Act would do it—as could other mechanisms that effectively tax accumulated wealth, real income (including unrealized gains), and/or the transfer of wealth between generations. Economist Zucman is spearheading an international movement to convince countries to pass a global 2 percent tax on the excess wealth of billionaires.

Back in Washington, we’ll need a lot of political will to buck the oligarchs and their entourages of lobbyists and $1,000-an-hour tax lawyers. But that would require a sea change. Just consider the fate of efforts to reform the estate tax, which Congress enacted in 1916 to rein in dynastic fortunes and finance the first World War.

Our inheritance tax system is so ridden with workarounds that billion-dollar fortunes can pass across generations and escape tax entirely. Using my analysis of Securities and Exchange Commission filings, writers at Bloomberg published an article showing how Nike founder Phil Knight was able to transfer more than $6 billion into a trust for his descendants, free of estate and gift tax. The collective wealth of Walmart founder Sam Walton’s descendants, virtually untouched by the estate tax, is closing in on $300 billion.

Lily Batchelder, an academic tax expert who recently served as assistant treasury secretary, wrote in a 2020 paper that the effective federal tax rate on inheritances is only 2.1 percent.

Sen. Bernie Sanders first introduced a comprehensive estate and gift tax reform bill in 2015. He has reintroduced it every session since—the latest version has only two Senate co-sponsors. Other attempts to beef up tax policy have fared no better. The top tax on ordinary wage income is still nearly double the tax on passive investment income such as stock dividends, which accrue largely to rich people. Efforts to impose a surtax on annual income exceeding $5 million have flopped.

Even the carried interest rule—which allows fund managers to pay low capital gains rates on the fees they charge for their services—remains in place. That’s thanks to outgoing Arizona Sen. Kyrsten Sinema, who in 2022 single-handedly forced the Senate Democratic caucus to remove from the Inflation Reduction Act a provision that would have closed this pointless loophole.

If the Republican Party wins control of the White House or either chamber of Congress in November, no tax on billionaire wealth will stand a chance. Republican lawmakers, in fact, are desperate to claw back the tens of billions of dollars their Democratic colleagues approved in 2022 to help the IRS enforce the law and pursue wealthy tax cheats—efforts that are finally beginning to pay off. (Some Republicans aim to abolish the tax agency entirely.)

When they last had complete control, in 2017, Republicans passed the Tax Cuts and Jobs Act, which, in addition to the provisions mentioned earlier, slashed the top corporate rate from 35 percent to 21 percent and created a temporary 20 percent deduction for “pass-through” income, all to the benefit of America’s richest families. Billionaire Mike Bloomberg pocketed more than $67 million in tax savings in just one year courtesy of the pass-through deduction.

That deduction is among a slew of wealth-friendly provisions set to expire at the end of 2025, setting up a battle royale in Washington. Despite a recent finding by economists that the Trump tax cuts failed to live up to their promise, Republicans are pushing to extend them, while some Democrats would like to see most of the provisions expire—and perhaps go even further to rein in runaway wealth.

The partisan impasse doesn’t bode well for staving off the arrival of America’s first trillionaire, and that presents an existential challenge. The existence even of multibillionaires—with all the power such wealth engenders—runs counter to the notion of the American Dream, wherein everyone is granted an opportunity to thrive. Already, the dreams of everyday Americans are sacrificed to bankroll the dreams of men like Bezos and Musk. Dreams of space travel and Martian colonies—dreams only oligarchs can chase.

Bezos said it himself. Clad in a Blue Origin jumpsuit and cowboy hat after his first space flight, he thanked the Amazon employees and customers, who “paid for all of this.”

As Murphy wrote in his Mother Jones essay, this was an extraordinary admission—“to point with a smile to a phallic rocket ship that goes nowhere new and assert that this is what delivery drivers peed in a water bottle for.”

“But this is the nature of oligarchy,” Murphy added: “Your sweat is their jet fuel.”

And the coming trillionaire class will squeeze the rest of us for every drop, American Dream be damned.