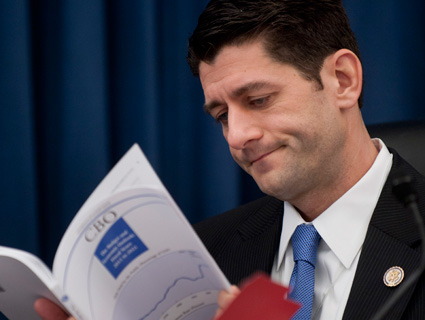

Are Republicans—and in particular, Paul Ryan—dedicated deficit hawks? Let’s make this simple. Here’s a timeline:

2001-08: Republicans, including Ryan, repeatedly vote to increase the deficit during the George Bush administration. This includes votes in favor of two huge tax cuts, two huge wars, and a big Medicare expansion, none of which are paid for.

January 20, 2009: Barack Obama is inaugurated.

October 2009: After nine months of focusing on stimulus and job creation, Obama begins his famous “pivot” toward long-term deficit reduction.

January 2010: A Senate proposal to create a bipartisan deficit commission is filibustered. Politico explains what happened: “The tepid support from Democratic leaders contributed to the loss, but more decisive was the number of Republicans switching under pressure from their party to block the measure. Six Republicans who had co-sponsored the bill as recently as last month voted against it.”

One day later: In his State of the Union address, Obama announces that he’ll act on his own: “I’ve called for a bipartisan fiscal commission, modeled on a proposal by Republican Judd Gregg and Democrat Kent Conrad….Yesterday, the Senate blocked a bill that would have created this commission. So I’ll issue an executive order that will allow us to go forward, because I refuse to pass this problem on to another generation of Americans.” This is the birth of the Bowles-Simpson Commission.

March 2010: Republicans appoint six members to the commission. One of them is Paul Ryan.

December, 2010: The Bowles-Simpson commission fails to agree on a plan. All three of the House Republican appointees vote against it, including Paul Ryan.

July 9, 2011: House Speaker John Boehner abandons negotiations with President Obama over an ambitious plan to cut the deficit by $4 trillion. The Washington Post explains why: “Boehner (R-Ohio) told Obama that their plan to ‘go big’….was crumbling under Obama’s insistence on significant new tax revenue.” One of the key opponents of compromise on taxes was Paul Ryan.

July 22, 2011: Boehner abandons yet another set of deficit negotiations when it becomes clear that House Republicans won’t support tax increases of any kind. Sam Stein quotes a Republican aide explaining that Ryan was, once again, one of the key opponents: “There were certain people … who thought the pursuit of the grand bargain was a useless pursuit because it could never pass anyway. Ryan was one of them. Ryan is opposed to tax increases.”

August 2012: The Romney/Ryan campaign explicitly endorses tax cuts, but declines to take a stand on how they would pay for this by closing tax loopholes. The campaign also explicitly rejects any cuts in defense spending. Their Medicare plan proposes no cuts at all for a decade, and after that it proposes the same growth rate cap as Obamacare. However, unlike Obamacare, it doesn’t include any plausible mechanisms for meeting that cap. Social Security reform is not addressed at all.

Actions speak louder than words, and I think you can draw your own conclusions from Ryan’s actions. Aside from a fondness for scary charts, there’s really nothing in his career that demonstrates any serious concern with the deficit. What he has demonstrated is consistent opposition to tax increases under any and all circumstances. I think you can also fairly say that he has no problem with spending cuts to social programs.

So that’s that. Ryan wants to cut taxes on the rich and cut spending on the poor. That’s his real preoccupation, not deficit reduction.